[ad_1]

StellarFi

Strengths

- Could enhance your credit score rating throughout the first few months

- Stories to the main credit score bureaus

- No hidden charges, deposits, or curiosity fees

- Entry to free monetary and credit score training

Weaknesses

- No free plan

- Restricted customer support availability

- Doesn’t report previous funds earlier than enrollment

- Nonetheless a younger firm

StellarFi is a credit score builder platform that doesn’t require you to borrow cash, pay curiosity, or make any safety deposits. As an alternative, it converts your common month-to-month payments into a robust credit-building device.

However how does StellarFi examine to the numerous credit-building merchandise out there available on the market, and does it actually work? On this StellarFi overview, we’ll clarify how the platform works, how a lot it prices, and the way it may help you construct credit score.

Desk of Contents

What Is StellarFi?

StellarFi is a credit-building service that opened to the general public in July 2022. In keeping with the monetary know-how (fintech) platform, over 130 million People don’t have entry to a homeownership path or a monetary security internet to afford emergencies.

Considered one of StellarFi’s key promoting factors is that it means that you can construct credit score and not using a bank card by reporting your month-to-month funds to 2 of the main credit score bureaus (Equifax and Experian). Moreover, you gained’t bear a tough credit score test which may influence credit score choices for the following two years.

How StellarFi Works

Getting began with StellarFi is simple. You merely join your month-to-month payments to a StellarFi Invoice Pay Card, which acts like a line of credit score. This credit score line pays your payments and instantly attracts the funds from a linked checking account, so that you by no means carry a stability or pay bank card curiosity.

StellarFi has been including extra perks as its buyer base expands. This contains invoice cost rewards and different perks on its upper-tier plans.

Let’s take a better have a look at how one can bolster your credit score rating.

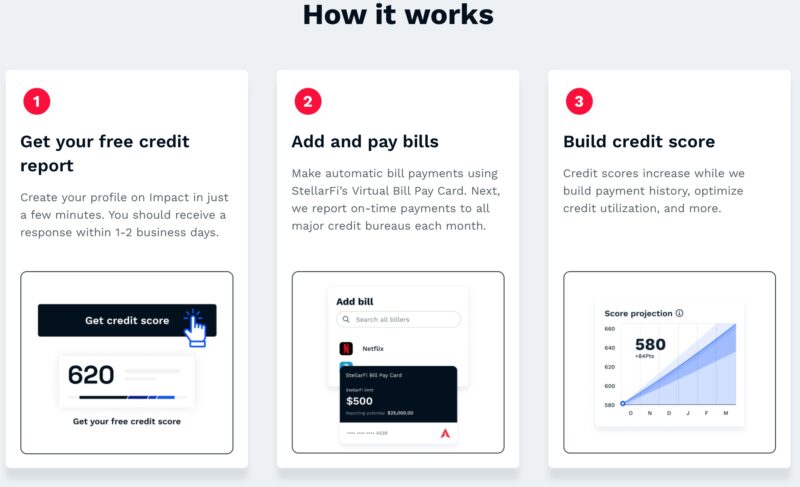

Free Credit score Report

You possibly can test your credit score rating at no cost after creating your StellarFi profile (there isn’t a influence in your credit score.) This offers a baseline from which to trace your progress with every invoice cost.

Your StellarFi credit score rating is a Vantage 3.0 scoring mannequin from the three bureaus. Most credit score rating apps solely monitor one or two scores.

One minor frustration is that you just see a Vantage 3.0 credit score rating as an alternative of a FICO Rating, which is the most typical credit score rating. The FICO Rating is the one the lenders use once they carry out a credit score test. So, the VantageScore isn’t as exact, however you could have a agency concept of your present credit score rating vary.

Add and Pay Payments

After finishing the preliminary account setup, you possibly can hyperlink your recurring month-to-month payments, similar to your cable TV, web, or cellphone invoice. You obtain a digital StellarFi cost card which you could present the biller to pay the month-to-month tab.

StellarFI’s auto-connect function allows you to rapidly replace your cost methodology with most nationwide manufacturers. You can even hyperlink payments manually with retailers that StellarFi doesn’t have a direct relationship with.

Along with linking payments, you join your checking account to StellarFi to pay payments. There aren’t any extra charges to make use of this service, similar to cost processing charges or financial institution switch charges. When a invoice is due, StellarFi will test your financial institution to make sure there are enough funds to pay the invoice to keep away from inflicting an overdraft. If there aren’t enough funds, the invoice is not going to be paid. If, for some cause, an overdraft does happen, StellarFi gained’t cost overdraft charges, however your main financial institution might.

Enhance Your Credit score Rating

By paying your payments by means of StellerFi, you determine a constructive cost historical past, as you’d with a credit score builder mortgage. Despite the fact that you’re not borrowing cash or shopping for on credit score, it seems as a month-to-month mortgage reimbursement.

Your month-to-month funds report to 2 of the main credit score bureaus:

This in depth reporting is much like the free service provided by Experian Increase. Nevertheless, Increase solely improves your Experian credit score rating. It gained’t assist you to construct credit score with Equifax or TransUnion.

You might discover a short lived drop in your credit score rating whenever you first be a part of StellarFi, as the road of credit score seems as a brand new account in your credit score experiences. A brand-new credit score account negatively impacts your common size of credit score historical past (15% of your whole credit score rating) and new credit score elements (10% of your whole rating).

You will get comparable outcomes to StellarFi by paying your payments with a secured or unsecured bank card. Nevertheless, a bank card isn’t excellent if it encourages you to overspend or you find yourself paying excessive bank card rates of interest. It additionally is not going to instantly take the cash out of your checking account whenever you pay a invoice.

It will also be tough to qualify for a bank card when you’ve got unhealthy or truthful credit score.

Different StellarFi credit-building instruments embrace:

- Creating custom-made credit score targets

- Credit score rating simulator

- Debt-to-income (DTI) calculator

- Dynamic rating projections

✨ Associated: Learn how to Improve Your Credit score Rating

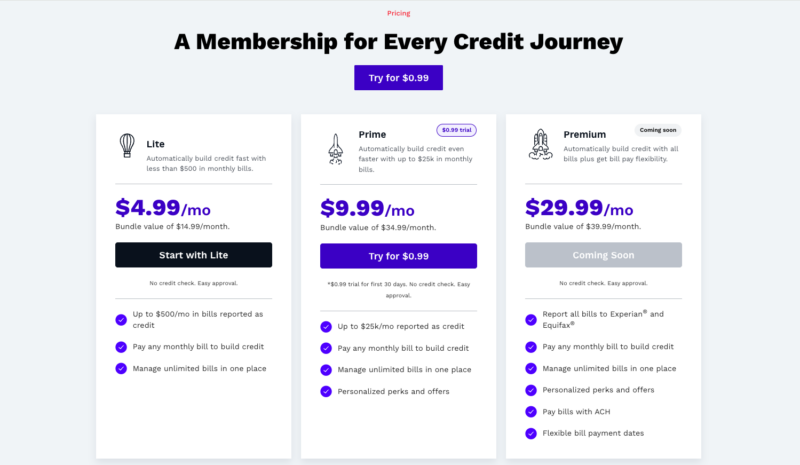

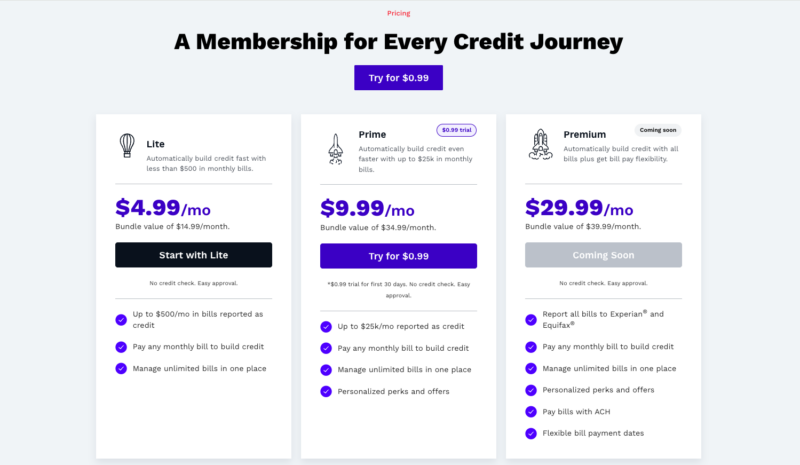

StellarFi Pricing

StellarFi provides three paid plans (there isn’t a free model.) You possibly can improve to a better plan to entry a better credit score restrict, which can assist you to reduce your credit score utilization ratio and let you pay extra payments. Right here’s a better have a look at what every plan has to supply.

Lite

The entry-level Lite plan prices $4.99 month-to-month and means that you can report as much as $500 of payments as credit score. Your preliminary line is smaller till you full your first invoice cost earlier than it expands to $500.

With Lite, you additionally get entry to different important StellarFI options, together with invoice pay auto-withdrawal, invoice cost notifications, credit score rating monitoring and alerts, 1-on-1 reside credit score teaching, and extra.

Prime

StellarFi’s mid-tier plan known as Prime, and it prices $9.99 month-to-month after a $0.99 trial for the primary 30 days.

You possibly can have as much as $25,000 in payments reported as credit score, a big enhance over the Lite plan.

Premium

StellarFi Premium is the highest-tier plan and prices $29.99 month-to-month. As of January 30, 2024, it’s but to go reside – there’s a ‘Coming Quickly’ discover on the StellarFI web site.

In keeping with StellarFi, the Premium plan will embrace the next unique advantages:

Is StellarFi Secure?

StellarFi makes use of bank-level 256 AES safety to encrypt your private information. The platform additionally makes use of randomized digital tokens and by no means shops your monetary data.

With that mentioned, tech glitches do happen, and there are occasions when invoice funds might not be accomplished as scheduled. If that occurs, StellarFi will make it proper by reimbursing any late charges and defending your privateness.

Do not forget that StellarFi is a younger firm, so that you have to be comfy coping with a startup.

Does StellarFi Truly Work?

You possibly can profit probably the most from StellarFi when you’ve got a credit score rating within the low 600s or under. Listed here are some reported outcomes from StellarFi customers on Trustpilot:

- Adrian N. reported a median 40-point enhance after the primary month

- Angel M. reported a median 45-point enhance over 4-6 months.

- Caitlynn D. reported a 20+ factors increase through the first 30 months.

- Destany B. reported a 28-point enhance after the primary month and nil factors after the second month earlier than leaving their overview.

Understand that these are on-line reviewers, and their outcomes can’t be substantiated.

Additionally, from Trustpilot, the most typical StellarFi complaints are inclined to encompass a scarcity of customer support choices. A number of evaluations point out that chatbots deal with the preliminary inquiry course of, and it may be tough to achieve a human.

In the end, you possibly can’t depend on StellarFi alone to strengthen your credit score historical past. You will need to additionally concentrate on paying your current loans and bank cards on time, avoiding opening new bank cards or loans, and protecting current bank card accounts open so long as attainable to have the utmost advantages.

Professionals & Cons

We’ve recognized the next strengths and weaknesses of StellarFi’s service providing:

Professionals

- You possibly can enhance your credit score rating throughout the first few months

- Stories to all three credit score bureaus

- No hidden charges or curiosity fees

- Can earn money rewards on invoice funds (Plus and Premium plans)

Cons

- No free plan

- Restricted customer support availability

- Doesn’t report previous funds earlier than enrollment

- Nonetheless a younger firm

Options to StellarFi

Earlier than signing up with StellarFi, it’s a good suggestion to discover different credit score builder platforms. With that in thoughts, listed here are a couple of StellarFi alternate options price contemplating.

Kikoff

Kikoff is a credit-building platform that provides a credit score account in addition to a secured bank card. The Kickoff Credit score Account is a $750 credit score line. As an alternative of paying payments, you should buy monetary training merchandise, and your cost exercise experiences to the three bureaus.

Two extra instruments embrace a secured bank card and a credit score builder mortgage. There’s a flat, $5 month-to-month price for Kickoff’s Credit score Service, however in contrast to some opponents, it doesn’t cost any charges for its secured card or credit score builder mortgage product.

Kikoff overview for extra.

CreditStrong

You possibly can enhance your private or enterprise credit score by means of CreditStrong. A number of credit score builder mortgage tiers can be found relying on how aggressively you wish to enhance your rating and your month-to-month funds.

Take a look at our CreditStrong overview to match credit-building plans.

Self

Self allows you to deposit month-to-month funds into an FDIC-insured certificates of deposit (CD). The credit score builder mortgage’s reimbursement time period is so long as 24 months with a month-to-month dedication between $24 and $150. Every cost experiences to the three main bureaus, and you might be reimbursed the contribution quantity on the maturity date, excluding charges.

Extra merchandise embrace a secured bank card and free hire reporting.

Learn our Self Credit score Builder overview to search out out extra.

FAQs

No onerous credit score test is important to use as you solely want a Social Safety quantity or particular person taxpayer identification quantity (ITIN) to report funds to your credit score bureaus.

Your StellarFi account seems as a revolving line of credit score much like a bank card. Every month, the platform experiences your month-to-month invoice cost quantity and compares it towards your whole restrict to calculate a credit score utilization ratio.

You possibly can pause or cancel your account by accessing the “handle account” button within the private data menu. Pausing your account retains your line open to forestall an account closure from showing in your credit score report, however it not experiences month-to-month funds as you’re not paying a membership price anymore.

Chat and electronic mail help is offered from 8 a.m. to six p.m. Central from Monday to Friday. Stay cellphone help is unavailable except the platform contacts you to schedule a name.

Is StellarFi Value It?

StellarFi is price contemplating in the event you’re on the lookout for a method to construct or restore your credit score and not using a secured bank card or different credit score product. One of many greatest benefits of utilizing StellarFi is that it helps you automate your funds and report your invoice funds to 2 main credit score bureaus, Experian and Equifax.

Simply be aware of the charges – sadly, StellarFi doesn’t supply a free tier – and be life like about how a lot StellarFi can increase your credit score rating. Do not forget that you’ll have to persist with sound credit-building practices, similar to well timed credit score funds and common budgeting, to remain on observe for monetary success.

[ad_2]