[ad_1]

This has been a wierd 12 months. Whereas we like to speak about how briskly know-how strikes, web time, and all that, in actuality the final main new concept in software program structure was microservices, which dates to roughly 2015. Earlier than that, cloud computing itself took off in roughly 2010 (AWS was based in 2006); and Agile goes again to 2000 (the Agile Manifesto dates again to 2001, Excessive Programming to 1999). The net is over 30 years previous; the Netscape browser appeared in 1994, and it wasn’t the primary. We expect the business has been in fixed upheaval, however there have been comparatively few disruptions: one each 5 years, if that.

2023 was a kind of uncommon disruptive years. ChatGPT modified the business, if not the world. We’re skeptical about issues like job displacement, at the very least in know-how. However AI goes to convey adjustments to virtually each side of the software program business. What is going to these adjustments be? We don’t know but; we’re nonetheless at the start of the story. On this report about how individuals are utilizing O’Reilly’s studying platform, we’ll see how patterns are starting to shift.

Only a few notes on methodology: This report relies on O’Reilly’s inside “Items Considered” metric. Items Considered measures the precise utilization of content material on our platform. The information used on this report covers January via November in 2022 and 2023. Every graph is scaled in order that the subject with the best utilization is 1. Subsequently, the graphs can’t be in contrast immediately to one another.

Keep in mind that these “models” are “seen” by our customers, who’re largely skilled software program builders and programmers. They aren’t essentially following the most recent tendencies. They’re fixing real-world issues for his or her employers. They usually’re selecting up the talents they should advance of their present positions or to get new ones. We don’t wish to low cost those that use our platform to rise up to hurry on the most recent sizzling know-how: that’s how the business strikes ahead. However to grasp utilization patterns, it’s vital to appreciate that each firm has its personal know-how stacks, and that these stacks change slowly. Corporations aren’t going to throw out 20 years’ funding in PHP to allow them to undertake the most recent widespread React framework, which is able to most likely be displaced by one other widespread framework subsequent 12 months.

Software program Improvement

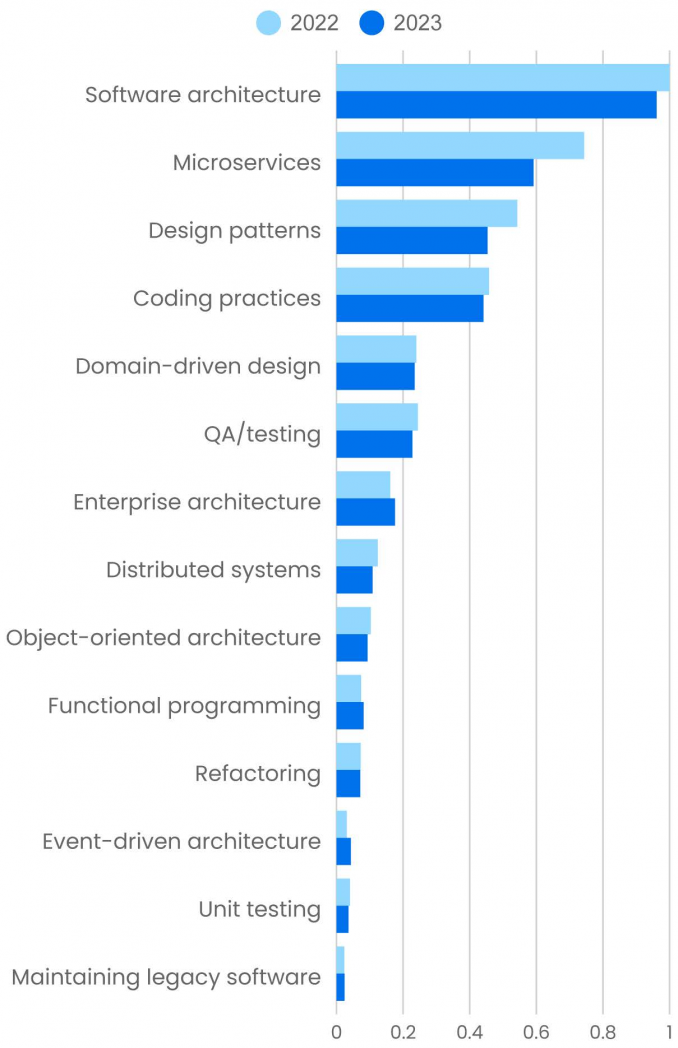

A lot of the matters that fall underneath software program improvement declined in 2023. What does this imply? Programmers are nonetheless writing software program; our lives are more and more mediated by software program, and that isn’t going to vary.

Software program builders are accountable for designing and constructing larger and extra complicated tasks than ever. That’s one development that received’t change: complexity is all the time “up and to the appropriate.” Generative AI is the wild card: Will it assist builders to handle complexity? Or will it add complexity all its personal? It’s tempting to take a look at AI as a fast repair. Who needs to study coding practices while you’re letting GitHub Copilot write your code for you? Who needs to study design patterns or software program structure when some AI software might ultimately do your high-level design? AI is writing low-level code now; as many as 92% of software program builders are utilizing it. Whether or not it will likely be in a position to do high-level design is an open query—however as all the time, that query has two sides: “Will AI do our design work?” is much less attention-grabbing than “How will AI change the issues we wish to design?” And the true query that may change our business is “How can we design techniques wherein generative AI and people collaborate successfully?”

Whatever the solutions to those questions, people might want to perceive and specify what must be designed. Our information reveals that almost all matters in software program structure and design are down year-over-year. However there are exceptions. Whereas software program structure is down 3.9% (a comparatively small decline), enterprise structure is up 8.9%. Area-driven design is especially helpful for understanding the conduct of complicated enterprise techniques; it’s down, however solely 2.0%. Use of content material about event-driven structure is comparatively small, nevertheless it’s up 40%. That change is vital as a result of event-driven structure is a software for designing massive techniques that should ingest information from many alternative streams in actual time. Useful programming, which many builders see as a design paradigm that may assist remedy the issues of distributed techniques, is up 9.8%. So the software program improvement world is altering. It’s shifting towards distributed techniques that handle massive flows of information in actual time. Use of content material on matters related to that shift is holding its personal or rising.

Microservices noticed a 20% drop. Many builders expressed frustration with microservices throughout the 12 months and argued for a return to monoliths. That accounts for the sharp decline—and it’s truthful to say that many organizations are paying the worth for transferring to microservices as a result of it was “the factor to do,” not as a result of they wanted the dimensions or flexibility that microservices can supply. From the beginning, microservice proponents have argued that one of the simplest ways to develop microservices is to begin with a monolith, then break the monolith into providers because it turns into crucial. If applied poorly, microservices ship neither scale nor flexibility. Microservices aren’t ultimate for brand new greenfield tasks, until you’re completely certain that you simply want them from the beginning—and even then, it’s best to suppose twice. It’s positively not a know-how to implement simply to comply with the most recent fad.

Software program builders run cold and hot on design patterns, which declined 16%. Why? It most likely depends upon the wind or the section of the moon. Content material utilization about design patterns elevated 13% from 2021 to 2022, so this 12 months’s decline simply undoes final 12 months’s acquire. It’s potential that understanding patterns appears much less vital when AI is writing numerous the code for you. It’s additionally potential that design patterns appear much less related when code is already largely written; most programmers keep current functions relatively than develop new greenfield apps, and few texts about design patterns focus on the patterns which are embedded in legacy functions. However each methods of pondering miss the purpose. Design patterns are widespread options to widespread issues which were noticed in observe. Understanding design patterns retains you from reinventing wheels. Frameworks like React and Spring are vital as a result of they implement design patterns. Legacy functions received’t be improved by refactoring current code simply to make use of some sample, however design patterns are helpful for extending current software program and making it extra versatile. And, in fact, design patterns are utilized in legacy code—even code that was written earlier than the time period was coined! Patterns are found, not “invented”; once more, they’re widespread options to issues programmers have been fixing because the starting of programming.

On the identical time, at any time when there’s a surge of curiosity in design patterns, there’s a corresponding surge in sample abuse: managers asking builders what number of patterns they used (as if sample depend had been a metric for good code), builders implementing FactoryFactoryFactory Factories, and the like. What goes round comes round, and the abuse of design patterns is a part of a suggestions loop that regulates using design patterns.

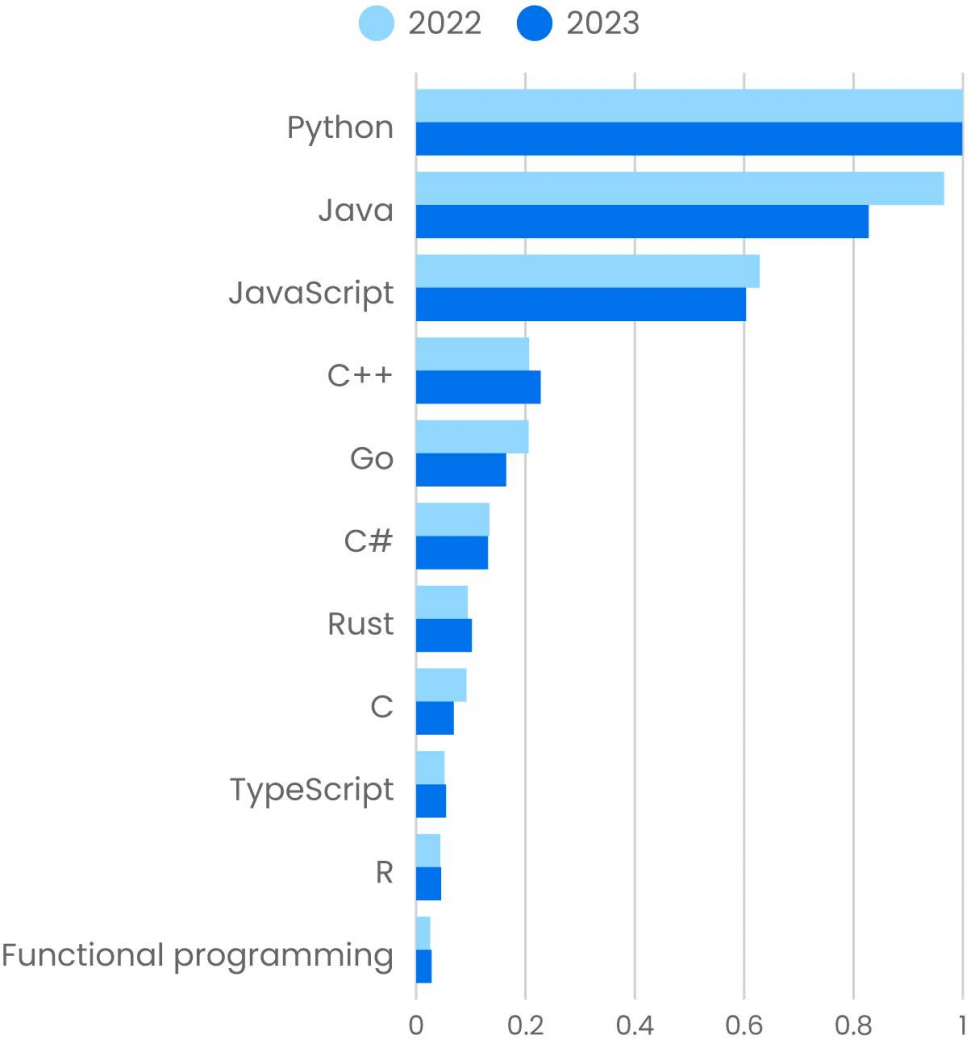

Programming and Programming Languages

A lot of the programming languages we monitor confirmed declines in content material utilization. Earlier than discussing specifics, although, we have to have a look at common tendencies. If 92% of programmers are utilizing generative AI to jot down code and reply questions, then we’d actually count on a drop in content material use. That will or is probably not advisable for profession improvement, nevertheless it’s a actuality that companies constructed on coaching and studying should acknowledge. However that isn’t the entire story both—and the larger story leaves us with extra questions than solutions.

Rachel Stephens supplies two fascinating items of the puzzle in a current article on the RedMonk weblog, however these items don’t match collectively precisely. First, she notes the decline in questions requested on Stack Overflow and states (fairly) that asking a nonjudgmental AI assistant may be a preferable approach for newcomers to get their questions answered. We agree; we at O’Reilly have constructed O’Reilly Solutions to offer that form of help (and are within the strategy of a significant improve that may make it much more helpful). However Stack Overflow reveals a broad peak in questions from 2014 to 2017, with a pointy decline afterward; the variety of questions in 2023 is barely 50% of the height, and the 20% decline from the January 2023 report back to the July report is just considerably sharper than the earlier drops. And there was no generative AI, no ChatGPT, again in 2017 when the decline started. Did generative AI play a job? It might be silly to say that it didn’t, however it could’t be the entire story.

Stephens factors to a different anomaly: GitHub pull requests declined roughly 25% from the second half of 2022 to the primary half of 2023. Why? Stephens guesses that there was elevated GitHub exercise throughout the pandemic and that exercise has returned to regular now that we’ve (incorrectly) determined the pandemic is over. Our personal concept is that it’s a response to GPT fashions leaking proprietary code and abusing open supply licenses; that would trigger programmers to be cautious of public code repositories. However these are solely guesses. This modification is seemingly not an error within the information. It may be a one-time anomaly, however nobody actually is aware of the trigger. One thing drove down programmer exercise on GitHub, and that’s inevitably part of the background to this 12 months’s information.

So, what does O’Reilly’s information say? Because it has been for a few years, Python is essentially the most extensively used programming language on our platform. This 12 months, we didn’t see a rise; we noticed a really small (0.14%) decline. That’s noise; we received’t insult your intelligence by claiming that “flat in a down market” is mostly a acquire. It’s actually truthful to ask whether or not a language as widespread as Python has gathered all of the market share that it’ll get. While you’re on the prime of the adoption curve, it’s tough to go any increased and far simpler to drop again. There are all the time new languages able to take a few of Python’s market share. Essentially the most important change within the Python ecosystem is Microsoft’s integration of Python into Excel spreadsheets, nevertheless it’s too early to count on that to have had an impact.

Use of content material about Java declined 14%, a major drop however not out of line with the drop in GitHub exercise. Like Python, Java is a mature language and should have nowhere to go however down. It has by no means been “nicely liked”; when Java was first introduced, folks walked out of the doorways of the convention room claiming that Java was lifeless earlier than you can even obtain the beta. (I used to be there.) Is it time to bounce on Java’s grave? That dance has been occurring since 1995, and it hasn’t been proper but.

JavaScript additionally declined by 3.9%. It’s a small decline and possibly not significant. TypeScript, a model of JavaScript that provides static typing and kind annotations, gained 5.6%. It’s tempting to say that these cancel one another out, however that’s not appropriate. Utilization of TypeScript content material is roughly one-tenth the utilization of JavaScript content material. However it’s appropriate to say that curiosity in sort techniques is rising amongst net builders. It’s additionally true that an rising variety of junior builders use JavaScript solely via a framework like React or Vue. Boot camps and different crash packages usually practice college students in “React,” with little consideration on the larger image. Builders skilled in packages like these might concentrate on JavaScript however might not consider themselves as JavaScript builders, and is probably not seeking to be taught extra in regards to the language exterior of a slender, framework-defined context.

We see progress in C++ (10%), which is stunning for an previous, well-established language. (C++ first appeared in 1985.) At this level in C++’s historical past, we’d count on it to be a headache for folks sustaining legacy code, not a language for beginning new tasks. Why is it rising? Whereas C++ has lengthy been an vital language for recreation improvement, there are indicators that it’s breaking out into different areas. C++ is a perfect language for embedded techniques, which frequently require software program that runs immediately on the processor (for instance, the software program that runs in a wise lightbulb or within the braking system of any trendy automobile). You aren’t going to make use of Python, Java, or JavaScript for these functions. C++ can also be a wonderful language for quantity crunching (Python’s numeric libraries are written in C++), which is more and more vital as synthetic intelligence goes mainstream. It has additionally change into the brand new “should have” language on résumés: figuring out C++ proves that you simply’re robust, that you simply’re a “critical” programmer. Job nervousness exists—whether or not or not it’s merited is a distinct query—and in an surroundings the place programmers are nervous about retaining their present jobs or trying ahead to discovering a brand new one, figuring out a tough however extensively used language can solely be an asset.

Use of content material about Rust additionally elevated from 2022 to 2023 (7.8%). Rust is a comparatively younger language that stresses reminiscence security and efficiency. Whereas Rust is taken into account tough to be taught, the concept reminiscence security is baked in makes it an vital different to languages like C++. Bugs in reminiscence administration are a major supply of vulnerabilities, as famous in NIST’s web page on “Safer Languages,” and Rust does a great job of implementing protected reminiscence utilization. It’s now utilized in working techniques (Linux kernel elements), software improvement, and even enterprise software program.

We additionally noticed 9.8% progress in content material about practical programming. We didn’t see positive aspects for any of the historic practical programming languages (Haskell, Erlang, Lisp, and Elixir) although; most noticed steep declines. Up to now decade, most programming languages have added practical options. Newer languages like Rust and Go have had them from the beginning. And Java has steadily added options like closures in a collection of updates. Now programmers will be as practical as they wish to be with out switching to a brand new language.

Lastly, there are some programming languages that we don’t but monitor however that we’re watching with curiosity. Zig is an easy crucial language that’s designed to be reminiscence protected, like Rust, however comparatively straightforward to be taught. Mojo is a superset of Python that’s compiled, not interpreted. It’s designed for top efficiency, particularly for numerical operations. Mojo’s purpose is to facilitate AI programming in a single language relatively than a mixture of Python and another language (usually C++) that’s used for performance-critical numerical code. The place are these languages going? It is going to be some years earlier than they attain the extent of Rust or Go, however they’re off to a great begin.

So what does all this inform us about coaching and ability improvement? It’s straightforward to suppose that, with Copilot and different instruments to reply all of your questions, you don’t have to put as a lot effort into studying new applied sciences. All of us ask questions on Google or Stack Overflow, and now now we have different locations to get solutions. Crucial as that’s, the concept asking questions can substitute coaching is naive. In contrast to many who’re observing the affect of generative AI on programming, we consider that it’ll improve the hole between entry-level abilities and senior developer abilities. Being a senior developer—being a senior something—requires a form of fluency that you could’t get simply from asking questions. I could by no means be a fluent consumer of Python’s pandas library (which I used extensively to jot down this report); I requested a lot of questions, and that has undoubtedly saved me time. However what occurs once I want to resolve the subsequent drawback? The form of fluency that you want to have a look at an issue and perceive how you can remedy it doesn’t come from asking easy “How do I do that?” questions. Nor does it preclude asking a lot of “I forgot how this operate works” questions. That’s why we’ve constructed O’Reilly Solutions, an AI-driven service that finds options to questions utilizing content material from our platform. However experience does require creating the mental muscle that comes from grappling with issues and fixing them your self relatively than letting one thing else remedy them for you. (And that features forcing your self to recollect all of the messy syntax particulars.) Individuals who suppose generative AI is a shortcut to experience (and the job title and wage that experience deserves) are shortchanging themselves.

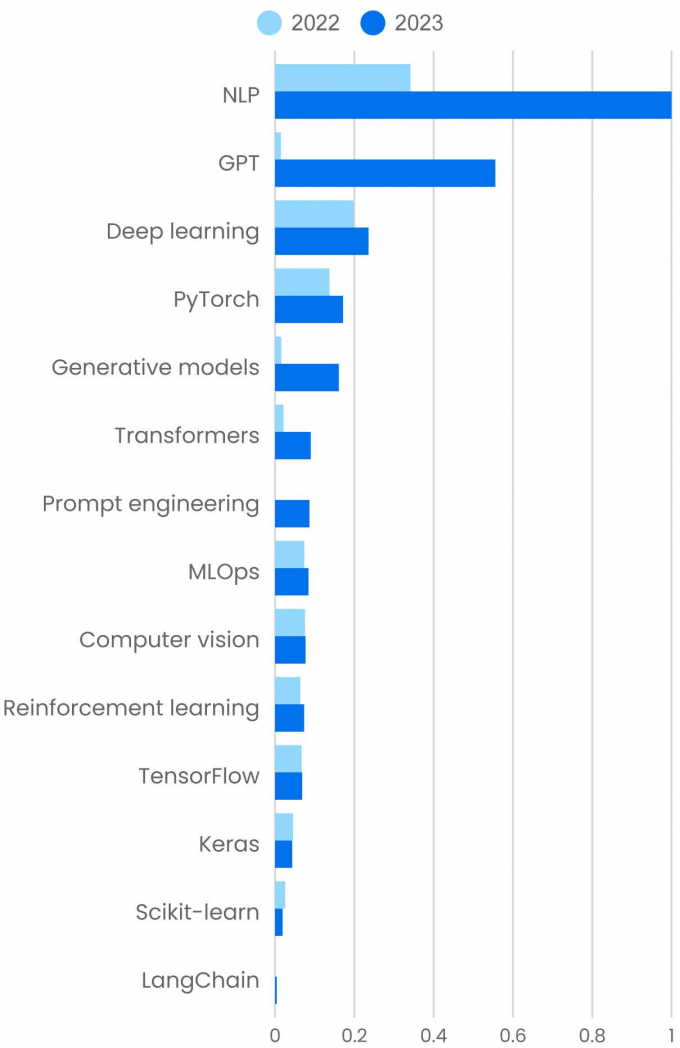

Synthetic Intelligence

In AI, there’s one story and just one story, and that’s the GPT household of fashions. Utilization of content material on these fashions exploded 3,600% prior to now 12 months. That explosion is tied to the looks of ChatGPT in November 2022. However don’t make the error of pondering that ChatGPT got here out of nowhere. GPT-3 created an enormous splash when it was launched in 2020 (full with a slipshod web-based interface). GPT-2 appeared in 2019, and the unique unnumbered GPT was even earlier. The actual innovation in ChatGPT wasn’t the know-how itself (although the fashions behind it characterize a major breakthrough in AI efficiency); it was packaging the mannequin as a chatbot. That doesn’t imply that the GPT explosion wasn’t actual. Whereas our evaluation of search tendencies reveals that curiosity in ChatGPT has peaked amongst our platform’s customers, curiosity in pure language processing (NLP) confirmed a 195% improve—and from a a lot increased start line.1 That is smart, given the extra technical nature of our viewers. Software program builders will likely be constructing on prime of the APIs for GPT and different language fashions and are doubtless much less fascinated about ChatGPT, the web-based chat service. Associated matters generative fashions (900%) and Transformers (325%) additionally confirmed enormous positive aspects. Immediate engineering, which didn’t exist in 2022, turned a major matter, with roughly the identical utilization as Transformers. So far as complete use, NLP is sort of twice GPT. Nevertheless you wish to learn the info, that is AI’s large 12 months, largely as a result of GPT fashions and the concept of generative AI.

However don’t assume that the explosion of curiosity in generative AI meant that different facets of AI had been standing nonetheless. Deep studying, the creation and software of neural networks with many layers, is prime to each side of contemporary AI. Utilization in deep studying content material grew 19% prior to now 12 months. Reinforcement studying, wherein fashions are skilled by giving “rewards” for fixing issues, grew 15%. These positive aspects solely look small compared to the triple- and quadruple-digit positive aspects we’re seeing in pure language processing. PyTorch, the Python library that has come to dominate programming in machine studying and AI, grew 25%. Lately, curiosity in PyTorch has been rising on the expense of TensorFlow, however TensorFlow confirmed a small acquire (1.4%), reversing (or at the very least pausing) its decline. Curiosity in two older libraries, scikit-learn and Keras, declined: 25% for scikit-learn and 4.8% for Keras. Keras has largely been subsumed by TensorFlow, whereas scikit-learn hasn’t but included the capabilities that may make it a great platform for constructing generative AI. (An try and implement Transformers in scikit-learn seems to be underway at Hugging Face.)

We’ve lengthy stated that operations is the elephant within the room for machine studying and synthetic intelligence. Constructing fashions and creating functions is difficult and enjoyable, however no know-how can mature if IT groups can’t deploy, monitor, and handle it. Curiosity in operations for machine studying (MLOps) grew 14% over the previous 12 months. That is strong, substantial progress that solely appears to be like small as compared with matters like generative AI. Once more, we’re nonetheless within the early levels—generative AI and enormous language fashions are solely beginning to attain manufacturing. If something, this improve most likely displays older functions of AI. There’s a rising ecosystem of startups constructing instruments for deploying and monitoring language fashions, that are essentially totally different from conventional functions. As firms deploy the functions they’ve been constructing, MLOps will proceed to see strong progress. (Extra on MLOps after we focus on operations beneath.)

LangChain is a framework for constructing generative AI functions round teams of fashions and databases. It’s usually used to implement the retrieval-augmented era (RAG) sample, the place a consumer’s immediate is used to lookup related objects in a vector database; these objects are then mixed with the immediate, producing a brand new immediate that’s despatched to the language mannequin. There isn’t a lot content material about LangChain obtainable but, and it didn’t exist in 2022, nevertheless it’s clearly going to change into a foundational know-how. Likewise, vector databases aren’t but in our information. We count on that to vary subsequent 12 months. They’re relatively specialised, so we count on utilization to be comparatively small, not like merchandise like MySQL—however they are going to be crucial.

AI wasn’t dominated completely by the work of OpenAI; Meta’s LLaMA and Llama 2 additionally attracted numerous consideration. The supply code for LLaMA was open supply, and its weights (parameters) had been simply obtainable to researchers. These weights shortly leaked from “researchers” to most people, the place they jump-started the creation of smaller open supply fashions. These fashions are a lot smaller than behemoths like GPT-4. A lot of them can run on laptops, they usually’re proving ultimate for smaller firms that don’t wish to depend on Microsoft, OpenAI, or Google to offer AI providers. (If you wish to run an open supply language mannequin in your laptop computer, attempt llamafile.) Whereas enormous “basis fashions” just like the GPT household received’t disappear, in the long term open supply fashions like Alpaca and Mistral might show to be extra vital to software program builders.

It’s straightforward to suppose that generative AI is nearly software program improvement. It isn’t; its affect extends to simply about each area. Our ChatGPT: Prospects and Pitfalls Superstream was essentially the most extensively attended occasion we’ve ever run. There have been over 28,000 registrations, with attendees and sponsors from industries as numerous as prescribed drugs, logistics, and manufacturing. Attendees included small enterprise homeowners, gross sales and advertising and marketing personnel, and C-suite executives, together with many programmers and engineers from totally different disciplines. We’ve additionally been working programs centered on particular industries: Generative AI for Finance had over 2,000 registrations, and Generative AI for Authorities over 1,000. And greater than 1,000 folks signed up for our Generative AI for Healthcare occasion.

Knowledge

In earlier years, we’d have informed the story of AI as a part of the story of information. That’s nonetheless appropriate; with its heavy emphasis on arithmetic and statistics, AI is a pure outgrowth of information science. However this 12 months, AI has change into the famous person that will get prime billing, whereas information is a supporting actor.

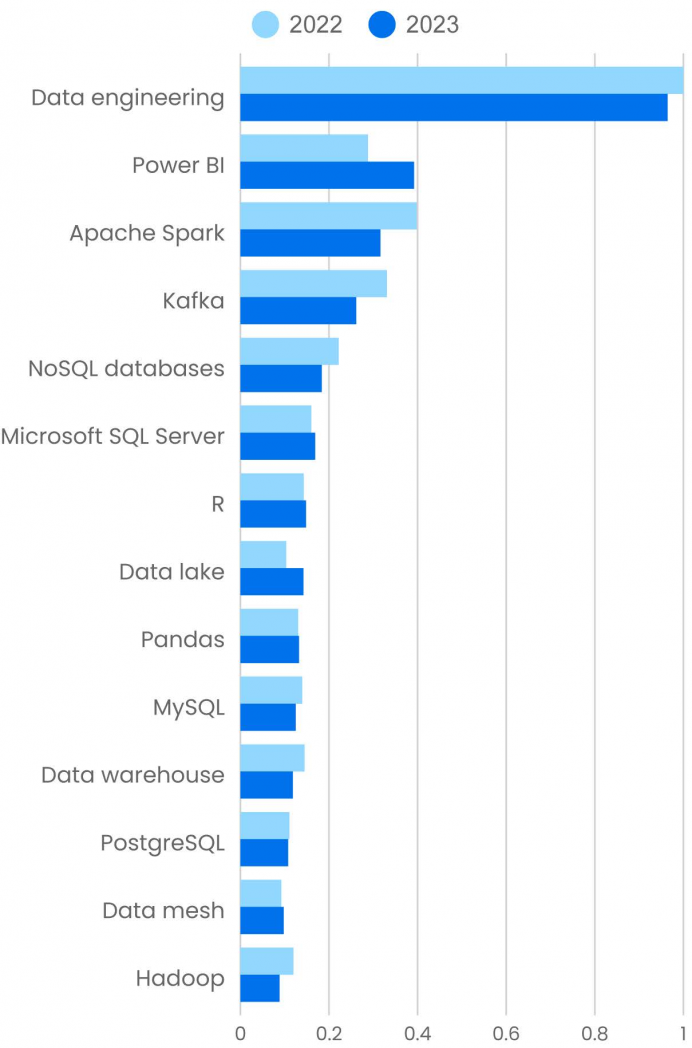

That doesn’t imply that information is unimportant. Removed from it. Each firm makes use of information: for planning, for making projections, for analyzing what’s taking place inside the enterprise and the markets they serve. So it’s not stunning that the second greatest matter in information is Microsoft Energy BI, with a 36% improve since 2022. SQL Server additionally confirmed a 5.3% improve, and statistics toolbox R elevated by 4.8%.

Knowledge engineering was by far essentially the most closely used matter on this class; it confirmed a 3.6% decline, stabilizing after an enormous acquire from 2021 to 2022. Knowledge engineering offers with the issue of storing information at scale and delivering that information to functions. It consists of transferring information to the cloud, constructing pipelines for buying information and getting information to software software program (usually in close to actual time), resolving the problems which are attributable to information siloed in numerous organizations, and extra. Two of crucial platforms for information engineering, Kafka and Spark, confirmed important declines in 2023 (21% and 20%, respectively). Kafka and Spark have been workhorses for a few years, however they’re beginning to present their age as they change into “legacy know-how.” (Hadoop, down 26%, is clearly legacy software program in 2023.) Curiosity in Kafka is more likely to rise as AI groups begin implementing real-time fashions which have up-to-the-minute data of exterior information. However we additionally should level out that there are newer streaming platforms (like Pulsar) and newer information platforms (like Ray).

Designing enterprise-scale information storage techniques is a core a part of information engineering. Curiosity in information warehouses noticed an 18% drop from 2022 to 2023. That’s not stunning; information warehouses additionally qualify as legacy know-how. Two different patterns for enterprise-scale storage present important will increase: Utilization of content material about information lakes is up 37% and, in absolute phrases, considerably increased than that of information warehouses. Utilization for information mesh content material is up 5.6%. Each lakes and meshes remedy a primary drawback: How do you retailer information in order that it’s straightforward to entry throughout a company with out constructing silos which are solely related to particular teams? Knowledge lakes can embody information in many alternative codecs, and it’s as much as customers to provide construction when information is utilized. A information mesh is a really distributed answer: every group is accountable for its personal information however makes that information obtainable all through the enterprise via an interoperability layer. These newer applied sciences are the place we see progress.

The 2 open supply information evaluation platforms had been nearly unchanged in 2023. Utilization of content material about R elevated by 3.6%; we’ve already seen that Python was unchanged, and pandas grew by 1.4%. Neither of those goes wherever, however options, notably to pandas, are showing.

Operations

Whether or not you name it operations, DevOps, or one thing else, this area has seen some vital adjustments prior to now 12 months. We’ve witnessed the rise of developer platforms, together with the associated matter, platform engineering. Each of these are too new to be mirrored in our information: you possibly can’t report content material use earlier than content material exists. However they’re influencing different matters.

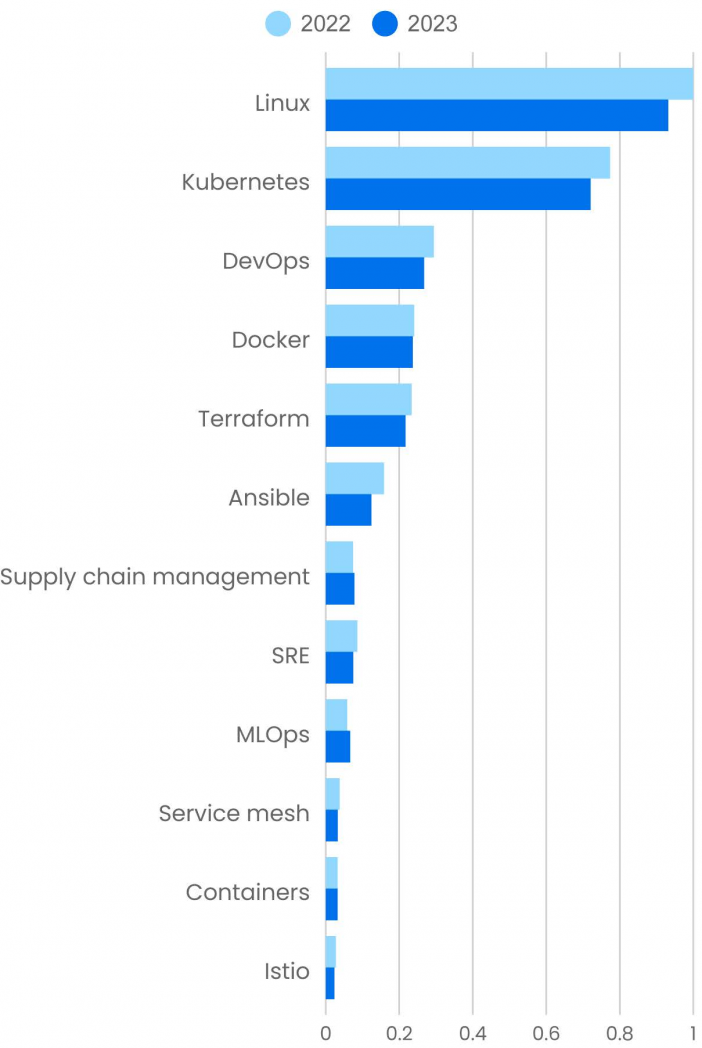

We’ve stated prior to now that Linux is desk stakes for a job in IT. That’s nonetheless true. However the extra the deployment course of is automated—and platform engineering is simply the subsequent step in “Automate All of the Issues”—the much less builders and IT employees have to learn about Linux. Software program is packaged in containers, and the containers themselves run as digital Linux cases, however builders don’t have to know how you can discover and kill out-of-control processes, do a backup, set up gadget drivers, or carry out any of the opposite duties which are the core of system administration. Utilization of content material about Linux is down 6.9%: not a significant change however presumably a mirrored image of the truth that the most recent steps ahead in deploying and managing software program defend folks from direct contact with the working system.

Comparable tendencies scale back what builders and IT employees have to learn about Kubernetes, the near-ubiquitous container orchestrator (down 6.9%). Anybody who makes use of Kubernetes is aware of that it’s complicated. We’ve lengthy anticipated “one thing easier” to return alongside and substitute it. It hasn’t—however once more, developer platforms put customers a step additional away from partaking with Kubernetes itself. Information of the main points is encapsulated both in a developer platform or, maybe extra usually, in a Kubernetes service administered by a cloud supplier. Kubernetes can’t be ignored, nevertheless it’s extra vital to grasp high-level ideas than low-level instructions.

DevOps (9.0%) and SRE (13%) are additionally down, although we don’t suppose that’s important. Phrases come and go, and these are going. Whereas operations is consistently evolving, we don’t consider we’ll ever get to the legendary state of “NoOps,” nor ought to we. As an alternative, we’ll see fixed evolution because the ratio of techniques managed to operations employees grows ever increased. However we do consider that sooner relatively than later, somebody will put a brand new identify on the disciplines of DevOps and its shut relative, SRE. That new identify may be “platform engineering,” although that time period says extra about designing deployment pipelines than about carrying the pager and retaining the techniques working; platform engineering is about treating builders as prospects and designing inside developer platforms that make it straightforward to check and deploy software program techniques with minimal ceremony. We don’t consider that platform engineering subsumes or replaces DevOps. Each are companions in bettering expertise for builders and operations employees (and ratcheting up the ratio of techniques managed to employees even increased).

That’s numerous pink ink. What’s within the black? Provide chain administration is up 5.9%. That’s not an enormous improve, however prior to now few years we’ve been compelled to consider how we handle the software program provide chain. Any important software simply has dozens of dependencies, and every of these dependencies has its personal dependencies. The entire variety of dependencies, together with each direct and inherited dependencies, can simply be a whole bunch and even hundreds. Malicious operators have found that they’ll corrupt software program archives, getting programmers to inadvertently incorporate malware into their software program. Sadly, safety issues by no means actually go away; we count on software program provide chain safety to stay an vital challenge for the foreseeable (and unforeseeable) future.

We’ve already talked about that MLOps, the self-discipline of deploying and managing fashions for machine studying and synthetic intelligence, is up 14%. Machine studying and AI characterize a brand new form of software program that doesn’t comply with conventional guidelines, so conventional approaches to operations don’t work. The listing of variations is lengthy:

- Whereas most approaches to deployment are based mostly on the concept an software will be reproduced from a supply archive, that isn’t true for AI. An AI system relies upon as a lot on the coaching information because it does on the supply code, and we don’t but have good instruments for archiving coaching information.

- Whereas we’ve stated that open supply fashions resembling Alpaca are a lot smaller than fashions like GPT-4 or Google’s Gemini, even the smallest of these fashions may be very massive by any cheap normal.

- Whereas we’ve gotten used to automated testing as a part of a deployment pipeline, AI fashions aren’t deterministic. A check doesn’t essentially give the identical end result each time it runs. Testing is not any much less vital for AI than it’s for conventional software program (arguably it’s extra vital), and we’re beginning to see startups constructed round AI testing, however we’re nonetheless at the start.

That’s only a begin. MLOps is a badly wanted specialty. It’s good to see rising curiosity.

Safety

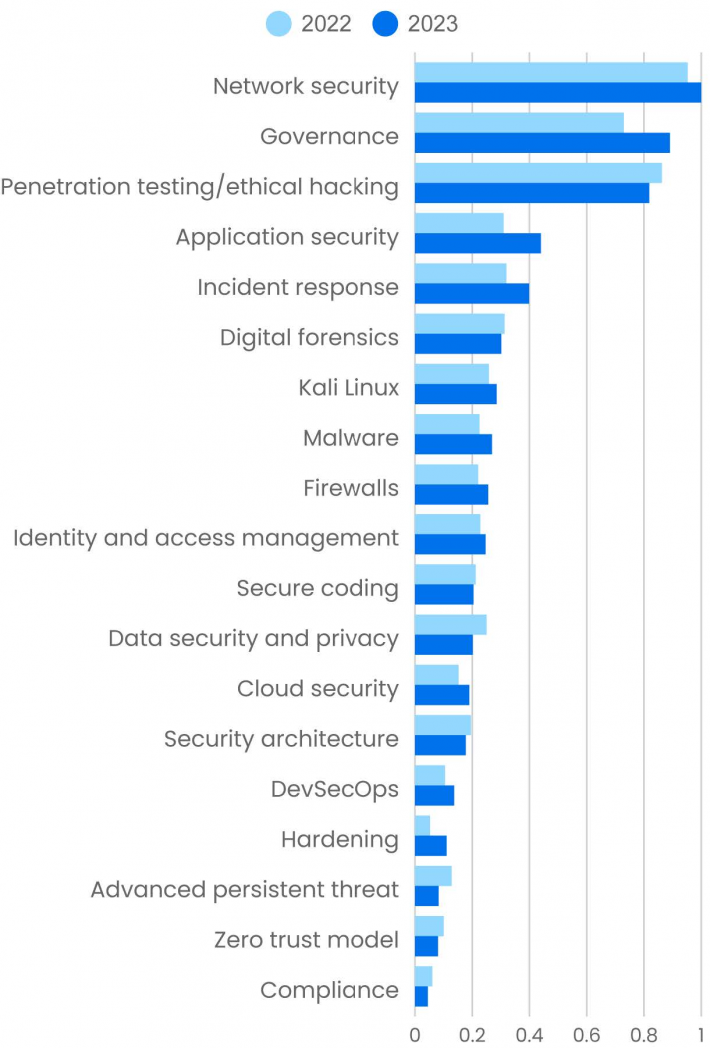

Virtually all branches of safety confirmed progress from 2022 to 2023. That’s a welcome change: within the current previous, many firms talked about safety however by no means made the funding wanted to safe their techniques. That’s altering, for causes which are apparent to anybody who reads the information. No one needs to be a sufferer of information theft or ransomware, notably now that ransomware has advanced into blackmail.

The challenges are actually quite simple. Community safety, retaining intruders off of your community, was essentially the most extensively used matter and grew 5%. Firewalls, that are an vital element of community safety, grew 16%. Hardening, a a lot smaller matter that addresses making techniques much less susceptible to assault, grew 110%. Penetration testing remained some of the extensively used matters. Utilization dropped 5%, though a ten% improve for Kali Linux (an vital software for penetration testers) largely offsets that decline.

The 22% progress in safety governance is one other indicator of modified attitudes: safety is not an advert hoc train that waits for one thing to occur after which fights fires. Safety requires planning, coaching, testing, and auditing to make sure that insurance policies are efficient.

One key to safety is figuring out who your customers are and which components of the system every consumer can entry. Id and entry administration (IAM) has usually been recognized as a weak spot, notably for cloud safety. As techniques develop extra complicated, and as our idea of “identification” evolves from people to roles assigned to software program providers, IAM turns into rather more than usernames and passwords. It requires a radical understanding of who the actors are in your techniques and what they’re allowed to do. This extends the previous concept of “least privilege”: every actor wants the flexibility to do precisely what they want, no extra and no much less. The usage of content material about IAM grew 8.0% prior to now 12 months. It’s a smaller acquire than we’d have favored to see however not insignificant.

Software safety grew 42%, displaying that software program builders and operations employees are getting the message. The DevSecOps “shift left” motion, which focuses on software program safety early within the improvement course of, seems to be successful; use of content material about DevSecOps was up 30%. Equally, those that deploy and keep functions have change into much more conscious of their obligations. Builders might design identification and entry administration into the code, however operations is accountable for configuring these appropriately and making certain that entry to functions is just granted appropriately. Safety can’t be added after the very fact; it must be a part of the software program course of from starting to the tip.

Superior persistent threats (APTs) had been everywhere in the information just a few years in the past. We don’t see the time period APT wherever close to as a lot as we used to, so we’re not shocked that utilization has dropped by 35%. Nonetheless, nation-states with subtle offensive capabilities are very actual, and cyber warfare is a crucial element of a number of worldwide conflicts, together with the conflict in Ukraine.

It’s disappointing to see that utilization of content material about zero belief has declined by 20%. That lower is greater than offset by the rise in IAM, which is an important software for zero belief. However don’t overlook that IAM is only a software and that the purpose is to construct techniques that don’t depend on belief, that all the time confirm that each actor is appropriately recognized and licensed. How will you defend your IT infrastructure in the event you assume that attackers have already got entry? That’s the query zero belief solutions. Belief nothing; confirm the whole lot.

Lastly, compliance is down 27%. That’s greater than offset by the substantial improve of curiosity in governance. Auditing for compliance is actually part of governance. Specializing in compliance itself, with out taking into consideration the bigger image, is an issue relatively than an answer. We’ve seen many firms that target compliance with current requirements and rules whereas avoiding the arduous work of analyzing danger and creating efficient insurance policies for safety. “It isn’t our fault that one thing unhealthy occurred; we adopted all the principles” is, at finest, a poor solution to clarify systemic failure. If that compliance-oriented mindset is fading, good riddance. Compliance, understood correctly, is a crucial element of IT governance. Understood badly, compliance is an unacceptable excuse.

Lastly, a phrase a couple of matter that doesn’t but seem in our information. There has, in fact, been numerous chatter about using AI in safety functions. AI will likely be an incredible asset for log file evaluation, intrusion detection, incident response, digital forensics, and different facets of cybersecurity. However, as we’ve already stated, there are all the time two sides to AI. How does AI change safety itself? Any group with AI functions must shield them from exploitation. What vulnerabilities does AI introduce that didn’t exist just a few years in the past? There are lots of articles about immediate injection, sneaky prompts designed to “jailbreak” AI techniques, information leakage, and different vulnerabilities—and we consider that’s solely the start. Securing AI techniques will likely be a vital matter within the coming years.

Cloud Computing

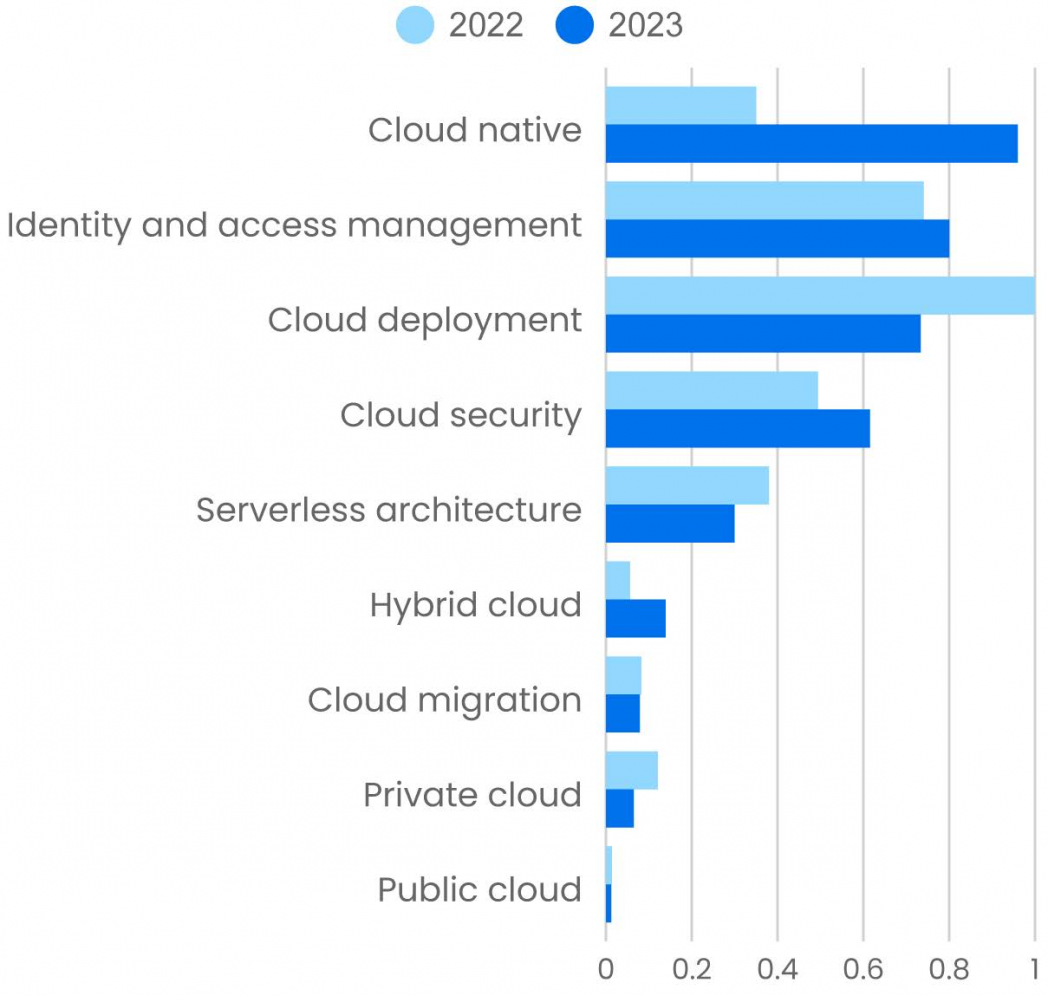

platform utilization for cloud-related matters, one factor stands out: cloud native. Not solely is it essentially the most extensively used matter in 2023, nevertheless it grew 175% from 2022 to 2023. This marks an actual transition. Up to now, firms constructed software program to run on-premises after which moved it to the cloud as crucial. Regardless of reviews (together with ours) that confirmed 90% or extra “cloud adoption,” we all the time felt that was very optimistic. Certain, 90% of all firms might have one or two experiments in the cloud—however are they actually constructing for the cloud? This enormous surge in cloud native improvement reveals that we’ve now crossed that chasm and that firms have stopped kicking the tires. They’re constructing for the cloud as their major deployment platform.

You would, in fact, draw the alternative conclusion by cloud deployment, which is down 27%. If firms are creating for the cloud, how are these functions being deployed? That’s a good query. Nevertheless, as cloud utilization grows, so does organizational data of cloud-related matters, notably deployment. As soon as an IT group has deployed its first software, the second isn’t essentially “straightforward” or “the identical,” however it’s acquainted. At this level within the historical past of cloud computing, we’re seeing few full newcomers. As an alternative we’re seeing current cloud customers deploying an increasing number of functions. We’re additionally seeing an increase in instruments that streamline cloud deployment. Certainly, any supplier price excited about has an incredible curiosity in making deployment so simple as potential.

Use of content material about cloud safety grew 25%, and identification and entry administration (IAM) grew 8%. An epidemic of information theft and ransomware that continues to at the present time put safety on the company map as a precedence, not simply an expense with annual finances requests that seemed like an extortion rip-off: “Nothing unhealthy occurred this 12 months; give us more cash and perhaps nothing unhealthy will occur subsequent 12 months.” And whereas the muse of any safety coverage is sweet native safety hygiene, it’s additionally true that the cloud presents its personal points. Id and entry administration: domestically, which means passwords, key playing cards, and (most likely) two-factor authentication. Within the cloud, which means IAM, together with zero belief. Identical concept, however it might be irresponsible to suppose that these aren’t harder within the cloud.

Hybrid cloud is a smaller matter space that has grown considerably prior to now 12 months (145%). This progress factors partly to the cloud turning into the de facto deployment platform for enterprise functions. It additionally acknowledges the fact of how cloud computing is adopted. Years in the past, when “the cloud” was getting began, it was straightforward for just a few builders in R&D to expense just a few hours of time on AWS relatively than requisitioning new {hardware}. The identical was true for data-aware entrepreneurs who needed to research what was taking place with their potential prospects—they usually would possibly select Azure. When senior administration lastly awoke to the necessity for a “cloud technique,” they had been already in a hybrid state of affairs, with a number of wildcat tasks in a number of clouds. Mergers and buyouts sophisticated the state of affairs extra. If firm A is primarily utilizing AWS and firm B has invested closely in Google Cloud, what occurs after they merge? Unifying behind a single cloud supplier isn’t going to be price it, despite the fact that cloud suppliers are offering instruments to simplify migration (similtaneously they make their very own clouds tough to depart). The cloud is of course hybrid. “Non-public cloud” and “public cloud,” when positioned as options to one another and to a hybrid cloud, odor like “final 12 months’s information.” It’s not stunning that utilization has dropped 46% and 10%, respectively.

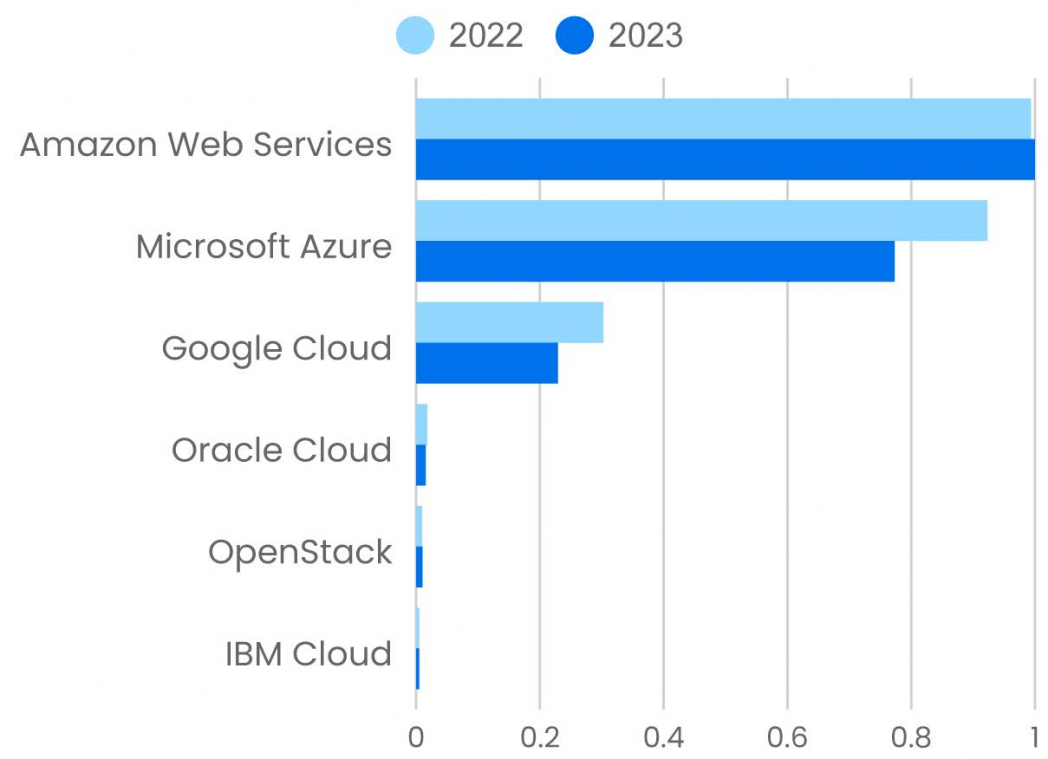

What in regards to the perennial horse race between Amazon Net Providers, Microsoft Azure, and Google Cloud? Is anybody nonetheless , besides maybe traders and analysts? AWS confirmed a really, very small acquire (0.65%), however Azure and Google Cloud confirmed important losses (16% and 22%, respectively). We anticipated to see Azure catch as much as AWS due to its lead in AI as a service, nevertheless it didn’t. So far as our platform is anxious, that’s nonetheless sooner or later.

Net Improvement

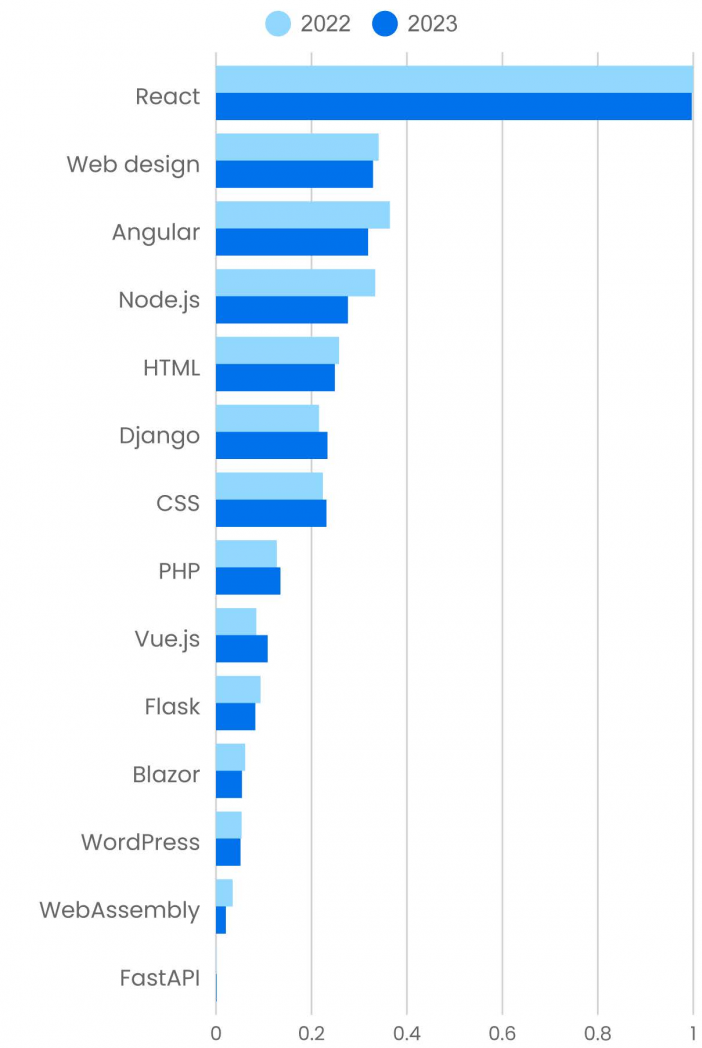

React and Angular proceed to dominate net improvement. JavaScript continues to be the lingua franca of net improvement, and that isn’t more likely to change any time quickly.

However the utilization sample has modified barely. Final 12 months, React was up, and Angular was sharply down. This 12 months, utilization of React content material hasn’t modified considerably (down 0.33%). Angular is down 12%, a smaller decline than final 12 months however nonetheless important. When a platform is as dominant as React, it might have nowhere to go however down. Is momentum shifting?

We see some attention-grabbing adjustments among the many much less widespread frameworks, each previous and new. First, Vue isn’t a big a part of the general image, and it isn’t new—it’s been round since 2014—but when its 28% annual progress continues, it is going to quickly change into a dominant framework. That improve represents a strong turnaround after shedding 17% from 2021 to 2022. Django is even older (created in 2005), nevertheless it’s nonetheless extensively used—and with an 8% improve this 12 months, it’s not going away. FastAPI is the latest of this group (2018). Despite the fact that it accounts for a really small share of platform use, it’s straightforward for a small change in utilization to have an enormous impact. An 80% improve is tough to disregard.

It’s price these frameworks in somewhat extra element. Django and FastAPI are each Python-based, and FastAPI takes full benefit of Python’s sort hinting function. Python has lengthy been an also-ran in net improvement, which has been dominated by JavaScript, React, and Angular. May that be altering? It’s arduous to say, and it’s price noting that Flask, one other Python framework, confirmed a 12% lower. As an entire, Python frameworks most likely declined from 2022 to 2023, however that is probably not the tip of the story. Given the variety of boot camps coaching new net programmers in React, the JavaScript hegemony will likely be arduous to beat.

What about PHP, one other long-standing framework that dates again to 1995, when the net was certainly younger? PHP grew 5.9% prior to now 12 months. The usage of content material about PHP is small in comparison with frameworks like React and Angular and even Django. PHP actually doesn’t encourage the thrill that it did within the Nineteen Nineties. However keep in mind that over 80% of the net is constructed on PHP. It’s actually not stylish, it’s not able to constructing the feature-rich websites that many customers count on—nevertheless it’s in all places. WordPress (down 4.8%), a content material administration system used for thousands and thousands of internet sites, relies on PHP. However whatever the variety of websites which are constructed on PHP or WordPress, Certainly reveals roughly 3 times as many job openings for React builders as for PHP and WordPress mixed. PHP actually isn’t going away, and it might even be rising barely. However we suspect that PHP programmers spend most of their time sustaining older websites. They already know what they want to try this, and neither of these elements drives content material utilization.

What about another extremely buzzworthy applied sciences? After displaying 74% progress from 2021 to 2022, WebAssembly (Wasm) declined by 41% in 2023. Blazor, an online framework for C# that generates code for Wasm, declined by 11%. Does that imply that Wasm is dying? We nonetheless consider Wasm is an important know-how, and we often examine superb tasks which are constructed with it. It isn’t but a mature know-how—and there are many builders keen to argue that there’s no want for it. We might disagree, however that misses the purpose. Utilization of Wasm content material will most likely decline steadily…till somebody creates a killer software with it. Will that occur? In all probability, however we are able to’t guess when.

What does this imply for somebody who’s attempting to develop their abilities as an online developer? First, you continue to can’t go flawed with React, and even with Angular. The opposite JavaScript frameworks, resembling Subsequent.js, are additionally good choices. Many of those are metaframeworks constructed on React, so figuring out them makes you extra versatile whereas leveraging data you have already got. When you’re seeking to broaden your abilities, Django can be a worthwhile addition. It’s a really succesful framework, and figuring out Python will open up different prospects in software program improvement that could be useful sooner or later, even when not now.

Certification

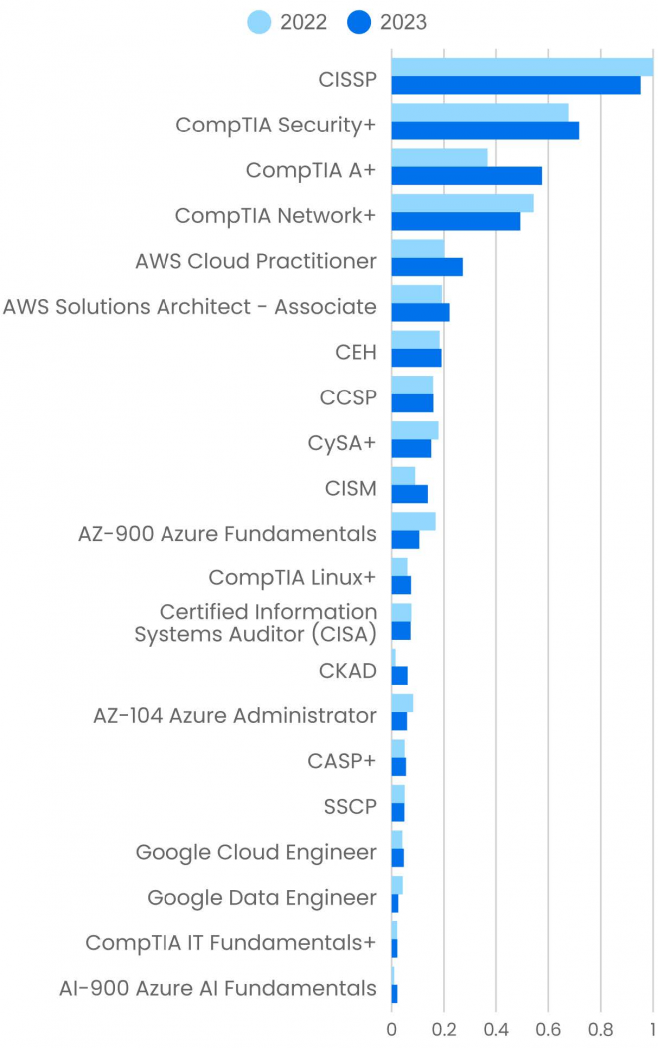

This 12 months, we took a distinct method to certification. Slightly than discussing certification for various topic areas individually (that’s, cloud certification, safety certification, and so on.), we used information from the platform to construct an inventory of the highest 20 certifications and grouped them collectively. That course of provides a barely totally different image of which certifications are vital and why. We additionally took a short have a look at O’Reilly’s new badges program, which provides one other perspective on what our prospects wish to be taught.

Based mostly on the utilization of content material in our platform (together with observe exams), the most well-liked certifications are safety certifications: CISSP (which declined 4.8%) and CompTIA Safety+ (which grew 6.0%). CISSP is an in-depth examination for safety professionals, requiring at the very least 5 years’ expertise earlier than taking the examination. Safety+ is extra of an entry-level examination, and its progress reveals that safety employees are nonetheless in demand. ISACA’s Licensed Data Safety Supervisor (CISM) examination, which focuses on danger evaluation, governance, and incident response, isn’t as widespread however confirmed a 54% improve. CompTIA’s Licensed Superior Safety Practitioner (CASP+) confirmed a ten% improve—not as massive however a part of the identical development. The Licensed Moral Hacker (CEH) examination, which focuses on methods helpful for penetration testing or red-teaming, is up 4.1%, after a decline final 12 months. These will increase mirror the place administration is investing. Hoping that there received’t be an incident has been changed by understanding publicity, setting up governance mechanisms to attenuate danger, and having the ability to reply to incidents after they happen.

What actually stands out, nevertheless, isn’t safety: it’s the elevated use of content material about CompTIA A+, which is up 58%. A+ isn’t a safety examination; it’s marketed as an entry-level examination for IT assist, stressing matters like working techniques, managing SaaS for distant work, troubleshooting software program, {hardware}, and networking issues, and the like. It’s testimony to the big quantity of people that wish to get into IT. Utilization of content material in regards to the CompTIA Linux+ examination was a lot decrease but in addition grew sharply (23%)—and, as we’ve stated prior to now, Linux is “desk stakes” for nearly any job in computing. It’s extra doubtless that you simply’ll encounter Linux not directly through containers or cloud suppliers relatively than managing racks of computer systems working Linux; however you’ll be anticipated to realize it. The Licensed Kubernetes Administrator (CKAD) examination additionally confirmed important progress (32%). Because it was first launched in 2014, Kubernetes has change into an inescapable a part of IT operations. The most important development in IT, going again 70 years or so, has been the rise within the ratio of machines to operators: from a number of operators per machine within the ’60s to at least one operator per machine within the period of minicomputers to dozens and now, within the cloud, to a whole bunch and hundreds. Advanced as Kubernetes is—and we admit, we hold searching for a less complicated different—it’s what lets IT teams handle massive functions which are applied as dozens of microservices and that run in hundreds of containers on an uncountable variety of digital machines. Kubernetes has change into an important ability for IT. And certification is turning into more and more engaging to folks working within the area; there’s no different space wherein we see a lot progress.

Cloud certifications additionally present prominently. Though “the cloud” has been round for nearly 20 years, and virtually each firm will say that they’re “within the cloud,” in actuality many firms are nonetheless making that transition. Moreover, cloud suppliers are consistently including new providers; it’s a area the place maintaining with change is tough. Content material about Amazon Net Providers was most generally used. AWS Cloud Practitioner elevated by 35%, adopted by AWS Options Architect (Affiliate), which elevated 15%. Microsoft Azure certification content material adopted, although the 2 most outstanding exams confirmed a decline: Azure Fundamentals (AZ-900) was down 37%, and Azure Administration (AZ-104) was down 28%. Google Cloud certifications trailed the remaining: Google’s Cloud Engineer confirmed strong progress (14%), whereas its Knowledge Engineer confirmed a major decline (40%).

Content material about Microsoft’s AI-900 examination (Azure AI Fundamentals) was the least-used among the many certifications that we tracked. Nevertheless, it gained 121%—it greater than doubled—from 2022 to 2023. Whereas we are able to’t predict subsequent 12 months, that is the form of change that tendencies are fabricated from. Why did this examination all of a sudden get so sizzling? It’s straightforward, actually: Microsoft’s funding in OpenAI, its integration of the GPT fashions into Bing and different merchandise, and its AI-as-a-service choices via Azure have all of a sudden made the corporate a frontrunner in cloud-based AI. Whereas we usually hedge our bets on smaller matters with large annual progress—it’s straightforward for a single new course or e book to trigger a big swing—AI isn’t going away, neither is Microsoft’s management in cloud providers for AI builders.

Late in 2023, O’Reilly started to supply badges tied to course completion on the O’Reilly studying platform. Badges aren’t certifications, however trying on the prime badges provides one other tackle what our prospects are fascinated about studying. The outcomes aren’t stunning: Python, GPT (not simply ChatGPT), Kubernetes, software program structure, and Java are the most well-liked badges.

Nevertheless, it’s attention-grabbing to take a look at the distinction between our B2C prospects (prospects who’ve purchased platform subscriptions as people) and B2B prospects (who use the platform through a company subscription). For many matters, together with these listed above, the ratio of B2B to B2C prospects is within the vary of two:1 or 3:1 (two or 3 times as many company prospects as people). The outliers are for matters like communications abilities, Agile, Scrum, private productiveness, Excel, and presentation abilities: customers from B2B accounts obtained these badges 4 (or extra) occasions as usually as customers with private accounts. This is smart: these matters are about teamwork and different abilities which are useful in a company surroundings.

There are few (if any) badge matters for which particular person (B2C) customers outnumbered company prospects; that’s only a reflection of our buyer base. Nevertheless, there have been some matters the place the ratio of B2B to B2C prospects was nearer to at least one. Essentially the most attention-grabbing of those involved synthetic intelligence: massive language fashions (LLMs), TensorFlow, pure language processing, LangChain, and MLOps. Why is there extra curiosity amongst people than amongst company prospects? Maybe by subsequent 12 months we’ll know.

Design

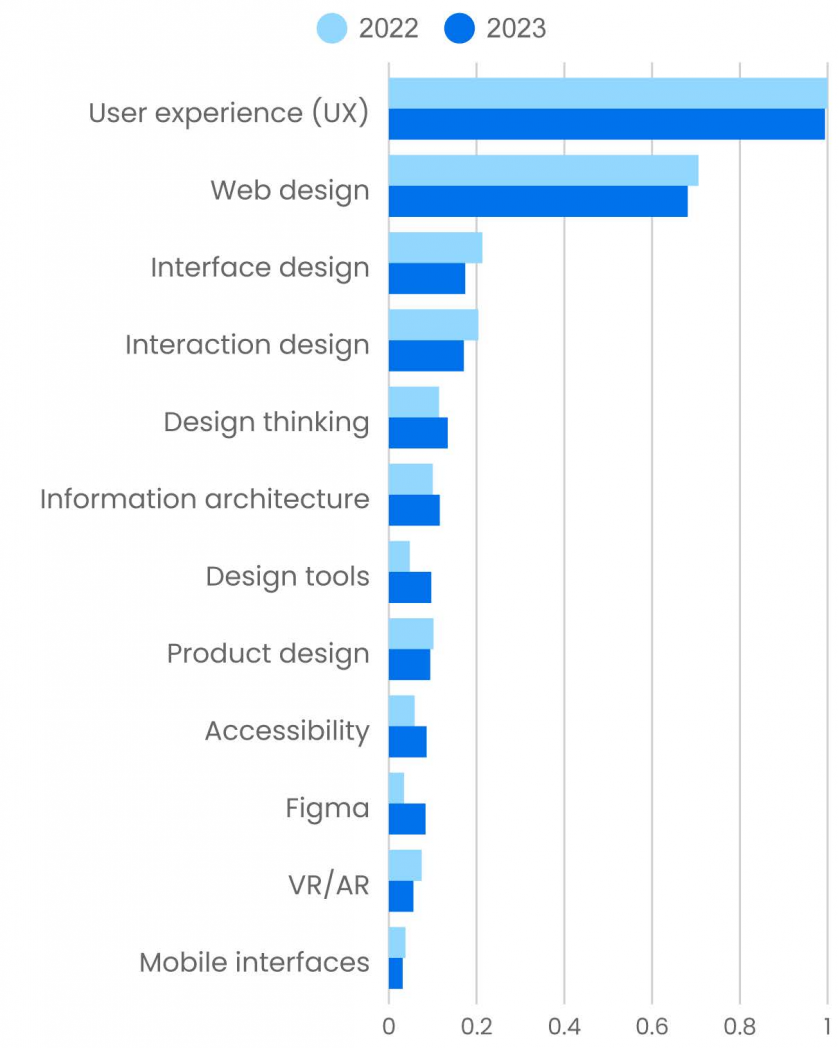

The vital story in design is about instruments. Matters like consumer expertise and net design are steady or barely down (down 0.62% and three.5%, respectively). However utilization about design instruments is up 105%, and the VC unicorn Figma is up 145%. Triple-digit progress most likely received’t proceed, nevertheless it’s actually price noticing. It highlights two vital tendencies that transcend typical design matters, like UX.

First, low-code and no-code instruments aren’t new, however many new ones have appeared prior to now 12 months. Their success has been aided by synthetic intelligence. We have already got AI instruments that may generate textual content, whether or not for a manufacturing web site or for a mockup. Quickly we’ll have no-code instruments that don’t simply spit out a wireframe however will be capable to implement the design itself. They are going to be good about what the consumer needs them to do. However to grasp the significance of low-code to design, you need to look past the use designers will make of those instruments. Designers can even be designing these instruments, together with different AI-powered functions. Instruments for designers should be well-designed, in fact: that’s trivial. However what many discussions about AI ignore is that designing functions that use AI nicely is way from trivial. We’ve all been blindsided by the success of ChatGPT, which made the GPT fashions immediately accessible to everybody. However when you begin excited about the chances, you understand {that a} chat is hardly a great interface for an AI system.2 What is going to the customers of those techniques actually need? We’ve solely simply began down that path. It is going to be an thrilling journey—notably for designers.

Second, Figma is vital as a result of it’s a breakthrough in instruments for collaboration. Instruments that enable distant staff to collaborate productively are essential when coworkers will be wherever: in an workplace, at dwelling, or on one other continent. The final 12 months and a half has been stuffed with speak about digital actuality, metaverses, and the like. However what few have realized is that the metaverse isn’t about carrying goggles—it’s about seamless collaboration with mates and coworkers. Use of content material about AR and VR dropped 25% as a result of folks have missed the true story: we don’t want 3D goggles; we’d like instruments for collaboration. And, as with low-code, collaboration instruments are each one thing to design with and one thing that must be designed. We’re on the sting of a brand new approach to take a look at the world.

Use of content material about info structure was up 16%, recovering from its decline from 2021 to 2022. The necessity to current info nicely, to design the environments wherein we eat info on-line, has by no means been extra vital. Daily, there’s extra info to soak up and to navigate—and whereas synthetic intelligence will little question assist with that navigation, AI is as a lot a design drawback as a design answer. (Although it’s a “good drawback” to have.) Designing and constructing for accessibility is clearly associated to info structure, and it’s good to see extra engagement with that content material (up 47%). It’s been a very long time coming, and whereas there’s nonetheless a protracted solution to go, accessibility is being taken extra significantly now than prior to now. Web sites which are designed to be usable by folks with impairments aren’t but the rule, however they’re not exceptions.

Skilled Improvement

Virtually everybody concerned with software program begins as a programmer. However that’s not often the place they finish. In some unspecified time in the future of their profession, they’re requested to jot down a specification, lead a staff, handle a gaggle, or perhaps even discovered an organization or function an govt in an current firm.

O’Reilly is the final firm to consider that software program builders are neck-bearded geeks who need nothing greater than to reside in a cave and kind on their terminals. We’ve spent most of our historical past combating in opposition to that stereotype. Nonetheless, going past software program improvement is a frequent supply of tension. That’s little question true for anybody stepping exterior their consolation zone in nearly any area, whether or not it’s accounting, legislation, medication, or one thing else. However in some unspecified time in the future in your profession, you need to do one thing that you simply aren’t ready to do. And, truthfully, one of the best leaders are normally those who’ve some nervousness, not those whose response is “I used to be born to be a frontrunner.”

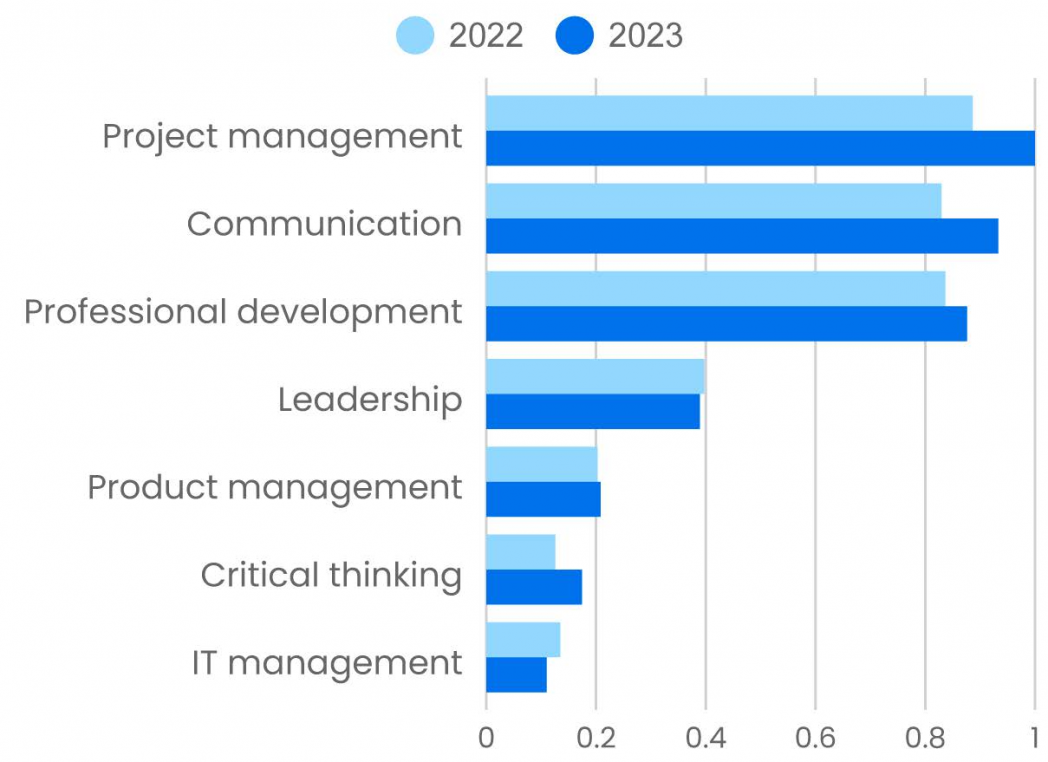

For the previous few years, our viewers has been fascinated about skilled progress that goes past simply writing software program or constructing fashions for AI and ML. Undertaking administration is up 13%; the flexibility to handle massive tasks is clearly seen as an asset for workers who’re searching for their subsequent promotion (or, in some instances, their subsequent job). No matter their objectives may be, anybody searching for a promotion or a brand new job—and even simply solidifying their maintain on their present job—can be nicely served by bettering their communications abilities (up 23%). Skilled improvement (up 22%) is a catch-all matter that seems to be responding to the identical wants. What’s driving this? 2023 started and ended with numerous information about layoffs. However regardless of well-publicized layoffs from enormous firms that overhired throughout the pandemic, there’s little proof that the business as an entire has suffered. People who find themselves laid off appear to be snapped up shortly by new employers. Nonetheless, nervousness is actual, and the emphasis we’re seeing on skilled improvement (and particularly, communications and undertaking administration abilities) is partially a results of that nervousness. One other a part of the story is little question the best way AI is altering the office. If generative AI makes folks extra environment friendly, it frees up time for them to do different issues, together with strategic excited about product improvement and management. It might lastly be time to worth “people and interactions over processes and instruments,” and “buyer collaboration over contract negotiation,” because the Agile Manifesto claims. Doing so would require a specific amount of reeducation, specializing in areas like communications, interpersonal abilities, and strategic pondering.

Product administration, the self-discipline of managing a product’s lifecycle from the preliminary concept via improvement and launch to the market, can also be a fascinating ability. So why is it solely up 2.8% and never 20% like undertaking administration? Product administration is a more moderen place in most firms; it has sturdy ties to advertising and marketing and gross sales, and so far as worry of layoffs is anxious (whether or not actual or media pushed), product administration positions could also be perceived as extra susceptible.

A have a look at the underside of the chart reveals that utilization of content material that teaches vital pondering grew 39%. That might be partially a consequence of ChatGPT and the explosion in synthetic intelligence. Everybody is aware of that AI techniques make errors, and virtually each article that discusses these errors talks in regards to the want for vital pondering to research AI’s output and discover errors. Is that the trigger? Or is the need for higher vital pondering abilities simply one other side {of professional} progress?

A Unusual Yr?

Again firstly, I stated this was a wierd 12 months. As a lot as we like to speak in regards to the pace at which know-how strikes, actuality normally doesn’t transfer that quick. When did we first begin speaking about information? Tim O’Reilly stated “Knowledge is the subsequent Intel Inside” in 2005, virtually 20 years in the past. Kubernetes has been round for a decade, and that’s not counting its prehistory as Google’s Borg. Java was launched in 1995, virtually 30 years in the past, and that’s not counting its set-top field prehistory as Oak and Inexperienced. C++ first appeared in 1985. Synthetic intelligence has a prehistory so long as computing itself. When did AI emerge from its wintry cave to dominate the info science panorama? 2016 or 2017, after we had been amazed by packages that would kind photos into canines and cats? Certain, Java has modified so much; so has what we do with information. Nonetheless, there’s extra continuity than disruption.

This 12 months was one of many few years that would genuinely be referred to as disruptive. Generative AI will change this business in vital methods. Programmers received’t change into out of date, however programming as we all know it’d. Programming could have extra to do with understanding issues and designing good options than specifying, step-by-step, what a pc must do. We’re not there but, however we are able to actually think about a day when a human language description leads reliably to working code, when “Do what I meant, not what I stated” ceases to be the programmer’s curse. That change has already begun, with instruments like GitHub Copilot. However to thrive in that new business, programmers might want to know extra about structure, extra about design, extra about human relations—and we’re solely beginning to see that in our information, primarily for matters like product administration and communications abilities. And maybe that’s the definition of “disruptive”: when our techniques and our expectations change sooner than our capacity to maintain up. I’m not nervous about programmers “shedding their jobs to an AI,” and I actually don’t see that concern among the many many programmers I speak to. However no matter occupation you’re in, you’ll lose out in the event you don’t sustain. That isn’t variety or humane; that’s capitalism. And maybe I ought to have used ChatGPT to jot down this report.3

Jerry Lee Lewis may need stated “There’s an entire lotta disruption goin’ on.” However regardless of all this disruption, a lot of the business stays unchanged. Individuals appear to have bored with the phrases DevOps and SRE, however so it goes: the half-life of a buzzword is inevitably quick, and these have been terribly long-lived. The issues these buzzwords characterize haven’t gone away. Though we aren’t but amassing the info (and don’t but have sufficient content material for which to gather information), developer platforms, self-service deployment, and platform engineering appear to be the subsequent step within the evolution of IT operations. Will AI play a job in platform engineering? We’d be shocked if it didn’t.

Motion to the cloud continues. Whereas we’ve heard speak of cloud “repatriation,” we see no proof that it’s taking place. We do see proof that organizations understand that the cloud is of course hybrid and that specializing in a single cloud supplier is short-sighted. There’s additionally proof that organizations are actually paying greater than lip service to safety, notably cloud safety. That’s an excellent signal, particularly after a few years wherein firms approached safety by hoping nothing unhealthy would occur. As many chess grandmasters have stated, “Hope isn’t a great technique.”

Within the coming 12 months, AI’s disruption will proceed to play out. What penalties will it have for programming? How will jobs (and job prospects) change? How will IT adapt to the problem of managing AI functions? Will they depend on AI-as-a-service suppliers like OpenAI, Azure, and Google, or will they construct on open supply fashions, which is able to most likely run within the cloud? What new vulnerabilities will AI functions introduce into the safety panorama? Will we see new architectural patterns and types? Will AI instruments for software program structure and design assist builders grapple with the difficulties of microservices, or will it simply create confusion?

In 2024, we’ll face all of those questions. Maybe we’ll begin to see solutions. One factor is obvious: it’s going to be an thrilling 12 months.

Footnotes

- Google Developments suggests that we could also be seeing a resurgence in ChatGPT searches. In the meantime, searches for ChatGPT on our platform seem to have bottomed out in October, with a really slight improve in November. This discrepancy aligns nicely with the distinction between our platform and Google’s. If you wish to use ChatGPT to jot down a time period paper, are you going to look Google or O’Reilly?

- Phillip Carter’s article, “All of the Arduous Stuff No one Talks About when Constructing Merchandise with LLMs,” is price studying. Whereas it isn’t particularly about design, virtually the whole lot he discusses is one thing designers ought to take into consideration.

- I didn’t. Not even for information evaluation.

[ad_2]

Pupil Member Gerard N. Piccini [second from left] with teammates from the IEEE Membership Pupil Department who competed within the IEEE Area 2 Micro Mouse contest. Gabrina Garangmau

Pupil Member Gerard N. Piccini [second from left] with teammates from the IEEE Membership Pupil Department who competed within the IEEE Area 2 Micro Mouse contest. Gabrina Garangmau