A brand new insurance coverage plan for youngsters, LIC’s Amritbaal 8% GUARANTEED Insurance coverage Plan, was launched on seventeenth Feb 2024. Does this coverage actually supply 8% returns?

LIC’s Amritbaal is a Non-Linked, Non-Taking part, Particular person, Financial savings, Life Insurance coverage plan. Therefore, it’s a conventional plan. The plan is obtainable each on-line and offline.

The primary query it’s a must to ask your self earlier than we go additional is – Is life insurance coverage required for a kid? Life insurance coverage is required for individuals who have monetary dependents and are additionally incomes members. In easy phrases, you don’t want life insurance coverage if nobody is financially depending on you or you might be financially impartial sufficient that your absence could not influence your monetary dependence.

Nonetheless, life insurance coverage firms regardless that the first enterprise is to supply life insurance coverage, supply us INSURANCE + INVESTMENT merchandise. Therefore, the aim of life insurance coverage on a child’s title is mainly to promote you an INSURANCE + INVESTMENT product, not a pure insurance coverage product.

LIC’s Amritbaal 8% GUARANTEED Plan for Youngsters – Options

What does this LIC’s Amritbaal GUARANTEED Plan for Youngsters give you?

- Assured Addition of Rs.80 per thousand Fundamental Sum Assured all through the Coverage Time period.

- Choice to decide on Life Insurance coverage protection in your youngster as per the wants.

- Flexibility to – Select from Single Premium and Restricted Premium Fee, Select the maturity age from 18 to 25 years for the assorted wants of your youngsters, and Go for fee of profit in installments.

- Choice to decide on Premium Waiver Profit rider on fee of extra premium.

- Mortgage facility to cater to your emergency wants.

LIC’s Amritbaal 8% GUARANTEED Plan for Youngsters – Eligibility

- Minimal age at entry – 0 Yrs (30 days)

- Most age at entry – 13 Years

- Minimal age at maturity – 18 Years

- Most age at maturity – 25 Years

- Minimal coverage time period – 10 Yrs (for restricted premium fee) and 5 years (for single premium)

- Most coverage time period – 25 Yrs (for each restricted premium fee and single premium)

- Premium fee time period – 5,6 and seven Yrs for normal premium

- Minimal Sum Assured – Rs.2,00,000

- Most Sum Assured – No restrict

- Proposers (mother and father) can go for premium waiver advantages. If the proposer has opted for this and if the proposer dies, then the longer term premiums can be waived off and coverage advantages will proceed as typical.

- Maturity and dying advantages both may be availed as lump sum payout or in installments.

Date of graduation of danger: In case the age at entry of the Life Assured is lower than 8 years, the danger will start both 2 years from the date of graduation of the coverage or from the coverage anniversary coinciding with or instantly following the attainment of 8 years of age, whichever is earlier. For these aged 8 years or extra at entry, danger will start instantly i.e. from the Date of issuance of coverage.

Date of vesting underneath the plan: The coverage shall mechanically vest within the Life Assured on the coverage anniversary coinciding with or instantly following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Company and the Life Assured.

LIC’s Amritbaal 8% GUARANTEED Plan for Youngsters – Advantages

a) Demise Profit

Right here, there are two choices underneath each restricted premium fee and single premium fee.

Restricted Premium Fee – Choice 1 – greater of seven occasions of an annual premium or fundamental sum assured. Choice 2- greater of 10 occasions of annual premium or fundamental sum assured.

Single Premium Fee – Choice 3 – greater of 1.25 occasions of single premium or fundamental sum assured. Choice 4- 10 occasions of single premium.

In case your youngster is under 8 years, and dying occurs after two years of coverage graduation (or after attaining the age of 8 years, whichever is early, then the nominee will obtain the Sum Assured + Accrued Assured Addition.

Nonetheless, within the case of minor Life Assured, whose age at entry is under 8 years, on dying earlier than the graduation of Danger, the Demise Profit payable, can be a refund of premium(s) paid (excluding taxes, any additional premium, rider premium(s), if any), with out curiosity.

Nominees can obtain the dying advantages in installments too.

b) Maturity Profit

On Life Assured surviving the stipulated Date of Maturity, offered the coverage is in power, “Sum Assured on Maturity” together with accrued Assured Additions for in-force coverage, shall be payable; the place “Sum Assured on Maturity” is the same as the Fundamental Sum Assured.

LIC’s Amritbaal GUARANTEED Addition

This plan provides Rs.80 per Rs.1,000 sum assured as a assured addition. Therefore, allow us to say you will have opted for Rs.5 Lakh of Sum Assured, then the yearly GA on this case is Rs.40,000 (Rs.5,00,000*Rs.80)/Rs.1,000.

Do do not forget that this GA accrued every year won’t earn a single penny of returns in subsequent years. For instance, within the first yr Rs.40,000, second yr Rs.40,000 and so forth…After 5 years, the accrued GA can be Rs.2,00,000 (Rs.40,000*5). In any other case, allow us to say you will have opted for 20 20-year coverage and the sum assured is Rs.5,00,000, then the GA out there on the maturity is Rs.8,00,000 (Rs.40,000*20).

Due to this, regardless that it seems like Rs.80 per thousand of sum assured or 8% GA, the returns will cut back drastically. I’ve defined the identical in an instance.

LIC’s Amritbaal 8% GUARANTEED Plan for Youngsters – Must you make investments?

As I discussed above, it’s a must to ask your self whether or not a LIFE INSURANCE is required in your youngster or not. I’ve talked about above that who truly can avail of life insurance coverage and who should avoid life insurance coverage. Right here, on this plan, the life assured is a baby and on whom nobody is financially dependent means LIFE INSURANCE IS WASTE.

Life insurance coverage ought to be all the time on the one that is incomes and who has monetary dependents. Therefore, one should ignore the INSRUACNCE a part of this product utterly.

Now, if we take into account this product as an funding, then whether or not this product supply us 8% returns? Allow us to see an instance offered by LIC itself in its gross sales brochure.

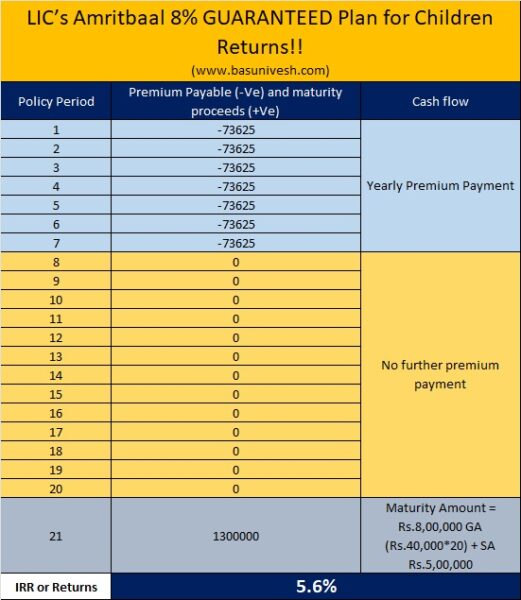

Instance – Age of the kid is 5 years, the maturity age is 25 years, the coverage time period is 20 years, the premium paying time period is 7 years, the mode of premium fee is yearly, the sum assured Rs.5,00,000 and the premium is Rs.73,625.

With this instance, if we calculate the returns at maturity, then it’s 5.6% however not 8%.

When the training inflation is rising on the charge of greater than 8% in India, by investing in such a low-yielding product, you might be devaluing your cash and risking the way forward for your child.

Nonetheless, in case you really feel 5.6% is the BEST return in your youngster’s future, and because the tagline related are LIC, GUARANTEE, and CHILD plan, then undoubtedly you have to make investments on this.

I repeat as soon as once more, in India if a product supplier provides three options, then traders blindly make investments – GUARANTEE, TAX BENEFITS, and CHILD or PENSION plan. None care about future worth and the way it will be useful for our future targets.