[ad_1]

Tax preparation is a kind of companies the place costs can range so much.

As a basic rule, the extra you do, the much less it’s going to value. The extra an accountant does, the extra it’s going to value. It’s not unreasonable for a professionally ready tax return to value a number of hundred {dollars} or extra.

How a lot this prices will rely upon the price of residing in your space (tax returns in Manhattan are dearer than in Mississippi, the bottom value of residing state within the U.S.), how busy the tax preparer is, and different comparable components.

📓 Fast Abstract: Based mostly on the Nationwide Society of Accountants survey from 2020, the common value to organize a Type 1040 tax return (normal deduction) is $263, when adjusted to December 2023 {dollars}. For those who itemize deductions, the common value to organize a Type 1040 tax return with Schedule A will increase to $368. (additionally adjusted to December 2023 {dollars})

Desk of Contents

Value for Skilled Tax Preparer

The Nationwide Society of Accountants (NSA) performed a survey again in 2020 and produced an Earnings and Charges of Accountants and Tax Preparers in public Apply Survey Report that outlines how a lot accountants have been charging for varied tax returns. It’s an enormous report, clocking in at 400+ pages, with detailed breakdowns by area.

We used the BLS’ CPI inflation calculator to regulate the figures for 2024 (we assumed the NSA’s report was April 2020 figures and adjusted them to December 2023 {dollars}, rounded to the closest greenback).

Nationwide Value to Put together Numerous Tax Kinds

- Type 1040, not itemized – $263

- Type 1040, itemized – $368

- Type 709 (Reward Tax) – $504

- Type 1041 (Fiduciary) – $689

- Type 1065 (Partnership) – $877

- Type 1120S (S Company) – $1,080

- Type 1120 (Company) – $1,092

- Type 706 (Estates) – $1,542

- File an Extension – $56

Additionally they break it out primarily based on the Schedules:

- Schedule B (Curiosity and Peculiar Dividends) – $50

- Schedule C (Enterprise) – $230

- Schedule E/Type 8949 (Positive factors & Losses) – $141

- Schedule E (Rental) – $173

- Schedule EIC (Earned Earnings Credit score) – $78

- Schedule F (Farm) – $239

- Schedule H (Family Employment Taxes) – $79

- Schedule SE (Self Employment Tax) – $49

The report additionally shares the hourly charges for getting ready varied kinds however I don’t really feel like that’s a mirrored image of value and extra a mirrored image of the world’s value of residing. I’d count on, on common, the kinds to take the identical period of time so an hourly fee doesn’t make a lot sense.

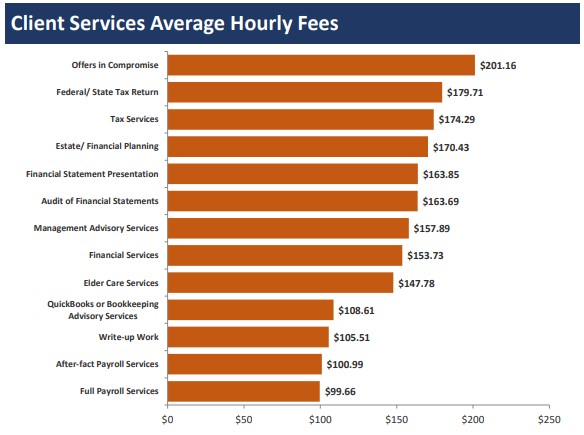

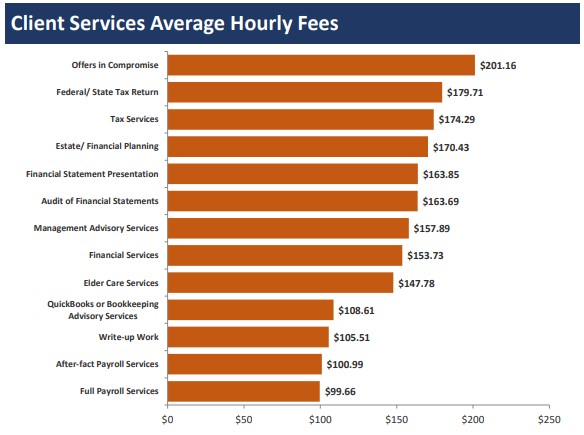

Additionally, if you happen to take a look at the report, the hourly fee is about $150 an hour throughout all kinds anyway. Additionally they go into hourly charges for different tax associated gadgets and people can run greater than getting ready the kinds (that are sometimes easy anyway):

If you’re reviewing accounting prices, this can provide you an concept of what all the pieces prices.

State Value to Put together Numerous Kinds

They surveyed sufficient accountants in varied states to get the identical above values for every state. The best method to see that’s to make use of their NSA Tax Preparation Payment calculator. For those who use the device, bear in mind it’s utilizing 2020 {dollars} and you need to add about 20% to account for inflation.

For instance, in Maryland, the common value to file a Type 1040 (Not Itemized & state return) is $548 (the device says $307). For those who itemize (provides a Schedule A), the associated fee goes as much as $989! (instruments says $552). These are larger than nationwide averages as a result of Maryland is the next value of residing state (roughly 22% larger than common).

It’s also possible to view how a lot they value in varied U.S. Census Areas however given state degree information, I’m undecided regional information is all that helpful.

Value for Tax Software program

As you possibly can see, the associated fee to rent an accountant to do your taxes is sort of excessive. One of the simplest ways to save cash is to do as a lot of it your self and for many tax conditions, you possibly can put together it your self.

How a lot you’ll pay is dependent upon how sophisticated your taxes are. It sometimes breaks all the way down to easy, average, and enterprise proprietor.

- Easy taxes are these returns that solely have W-2 revenue and don’t itemize.

- Average returns embrace something greater than only a W-2 and the usual deduction however are simpler than having a enterprise. This might embrace funding revenue, a rental property, and so forth, and any problems, akin to itemizing.

- Lastly, enterprise returns are probably the most sophisticated and can value probably the most.

When you’ve got a easy tax return, there’s a good likelihood you will get your return performed free of charge. Right here’s an inventory of free tax software program.

In case your taxes are extra sophisticated however your revenue is beneath $79,000, take a look at the IRS Free File program. They’ve partnered with a number of tax preparation companies so that you simply don’t have to pay to file your federal returns. There could also be a value for state returns, however some preparers gained’t cost you for that both.

When you’ve got reasonably sophisticated taxes, you possibly can count on to pay round $70 for each federal and state. And if you happen to personal a enterprise, you possibly can count on to be charged round $100.

If doing all of your taxes your self appears a bit scary, don’t fear. Most tax software program will provide you with entry to a reside tax skilled for an extra payment.

The least costly method to entry a tax professional is with FreeTaxUSA. With FreeTaxUSA all federal returns are free and state returns are $14.99. Then, you possibly can add on reside tax help for $39.99. Meaning even enterprise house owners might do their taxes with the assistance of a tax skilled for $55, assuming one state return.

For those who qualify for a free return with TurboTax you possibly can truly add on reside tax help free of charge till March 31, 2024.

Conclusion

Tax preparation is dear, and accountants are famously swamped throughout this time of yr. For those who have been to name up an accountant proper now and inquire about companies, chances are high they’re too busy to take you on as a brand new consumer. They’d ask to your paperwork, do a fast estimate of your taxes due, after which request an extension.

For those who’re getting tax preparation quotes and balking on the worth (it’s pure to be hesitant if you see quotes within the many lots of of {dollars}!), attempt doing it your self.

The perfect-case situation is that you simply file your taxes and save lots of of {dollars}. The worst case is that you simply realized you want an expert and spent just a few hours studying extra about your scenario (and now you already know you want somebody).

If you wish to lower your expenses, you wish to do as a lot as you possibly can your self.

[ad_2]