[ad_1]

Many individuals purchased I Bonds when inflation was excessive. Many individuals cashed out I Bonds to purchase new I Bonds or TIPS when the mounted charge on I Bonds and TIPS yields went up final 12 months. Others merely cashed out I Bonds to do one thing else with the cash.

By default, you pay tax on all of the curiosity earned whenever you money out I Bonds. Right here’s methods to report the curiosity earnings in tax software program TurboTax, H&R Block, and FreeTaxUSA.

Discover the 1099 Type

TreasuryDirect sends an e mail in late January when the 1099 type is prepared. You need to get the 1099 type on-line out of your TreasuryDirect account. TreasuryDirect doesn’t mail the 1099 type to you. Right here’s methods to discover the 1099 type within the TreasuryDirect account.

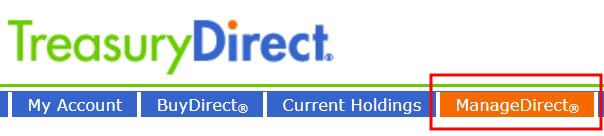

Log in to your TreasuryDirect account and click on on ManageDirect on the highest.

Scroll down to seek out the hyperlink for the earlier 12 months beneath the heading Handle My Taxes.

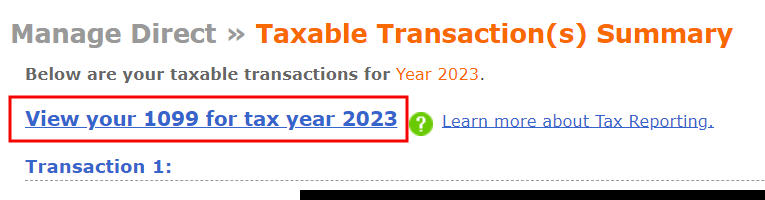

You see a listing of your taxable transactions within the earlier 12 months. Your 1099 type is behind the hyperlink “View your 1099 for tax 12 months 20xx” earlier than the record begins.

Save the 1099 Type

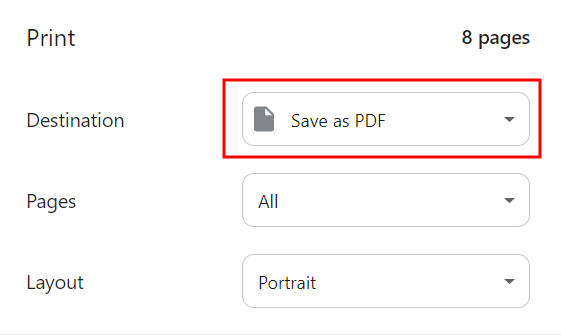

Clicking on that hyperlink brings you to the 1099 type. It’s only a net web page, not a PDF file. It doesn’t appear to be a 1099 type however that’s simply how TreasuryDirect does it.

It can save you it as a PDF through the use of the print operate of your browser (Ctrl + P on a Home windows laptop or Command + P on a Mac). The mainstream browsers have a “Save as PDF” function whenever you print (see directions for Chrome, Safari, and Firefox).

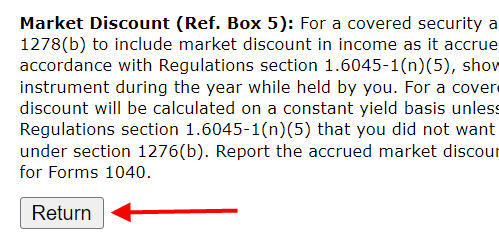

After you save the 1099 type as a PDF, you should definitely scroll to the underside of that web page and click on on the Return button. Unhealthy issues will occur in case you click on on the again button in your browser!

Examine Each Account

In case you have a number of TreasuryDirect accounts (partner, youngsters, enterprise, belief, …), repeat the steps above in every account. For those who deposited paper bonds into your TreasuryDirect account right into a Conversion Linked Account and also you cashed out bonds within the Conversion Linked Account with out transferring the bonds to your predominant account, go into the Conversion Linked Account and discover the 1099 type there.

It’s behavior to only log in to each TreasuryDirect account you’ve got and search for the 1099 type. You’ll hear from the IRS for under-reporting your earnings in case you have a 1099 type sitting there in an account you didn’t test and also you don’t embody the curiosity in your tax return.

Learn the 1099 Type

Most banks and brokers current the 1099 type as a abstract adopted by supporting particulars. TreasuryDirect takes the other strategy. They current the small print first, adopted by a complete on the finish.

TreasuryDirect’s 1099 type additionally features a bunch of irrelevant info. My 1099 type is 8 pages lengthy after I want just one quantity from it. You must hunt for the small bits you want.

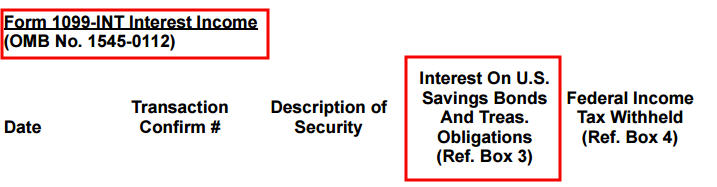

For those who solely had I Bonds within the TreasuryDirect account, not common Treasuries or TIPS, you solely want to have a look at the 1099-INT part. The curiosity is within the column labeled “Curiosity on U.S. Financial savings Bonds And Treas. Obligations (Ref. Field 3).” The Field 3 half is vital as a result of it tells you the place the quantity goes whenever you enter it into tax software program. As a result of it was an internet web page saved as a PDF, this heading might break throughout two pages. A reader despatched me this screenshot of his 1099 type:

The vital Field 3 half is well missed when it exhibits up on a distinct web page.

For those who selected to have TreasuryDirect withhold taxes whenever you cashed out I Bonds (see Voluntary Tax Withholding on Promoting I Bonds at TreasuryDirect), the tax withheld quantity is reported within the column after the curiosity. Be aware that it goes into Field 4 whenever you enter it into tax software program.

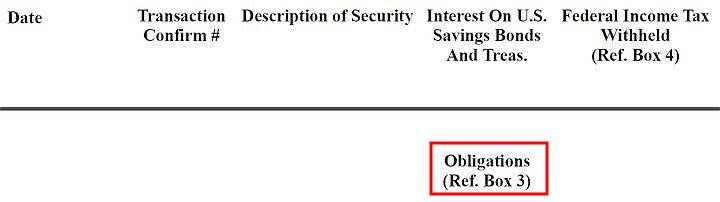

Look previous the detailed itemizing of every sale to seek out the full on the finish of the 1099-INT part. That’s the quantity you want on your tax software program.

Enter Into Tax Software program

Getting the 1099 type, saving it as a PDF, looking for the quantity you want from the 1099 type, and repeating the method for a number of accounts are essentially the most troublesome components of this journey. Coming into the quantity into tax software program is comparatively simple.

We begin with TurboTax. Please skip over to H&R Block or FreeTaxUSA in case you don’t use TurboTax.

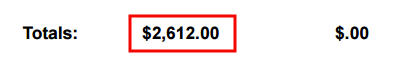

TurboTax

Go to Federal Taxes -> Wages & Revenue -> Curiosity on 1099-INT in TurboTax. You’ll need to sort it in your self as a result of TreasuryDirect doesn’t assist importing the 1099 type.

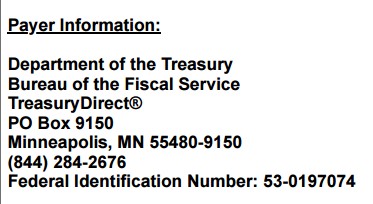

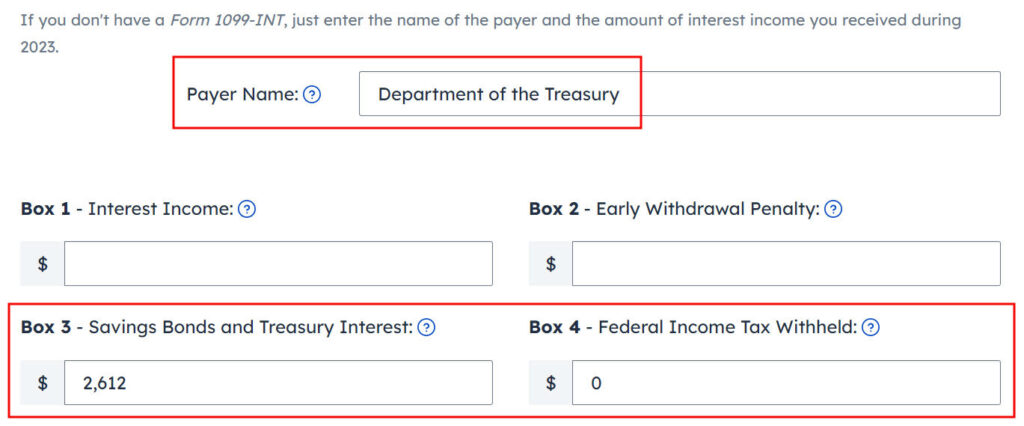

Enter the payer as “Division of the Treasury” as a result of that’s how the Payer Data exhibits on the 1099 type from TreasuryDirect.

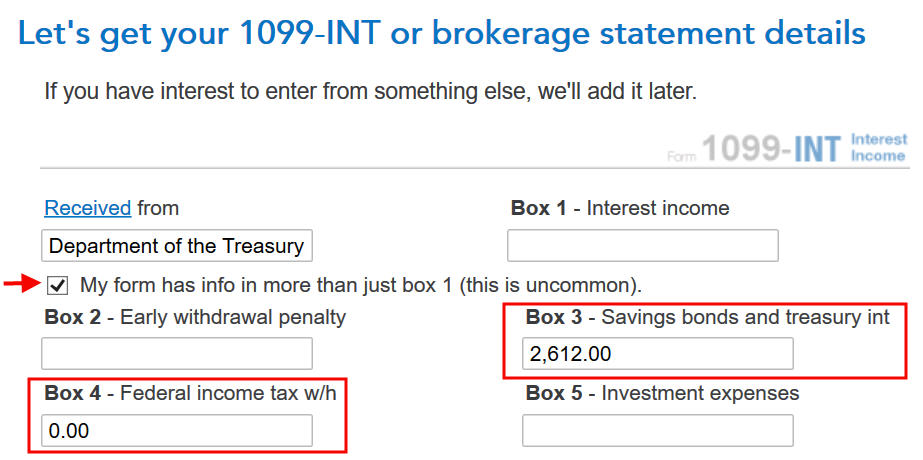

Examine that field “My type has information in additional than simply field 1 (that is unusual).” to increase the shape as a result of we have to put our quantity in Field 3 (and Field 4 in case you had taxes withheld). Enter the totals in Field 3 and Field 4. Depart Field 1 clean. Click on on Proceed on the backside.

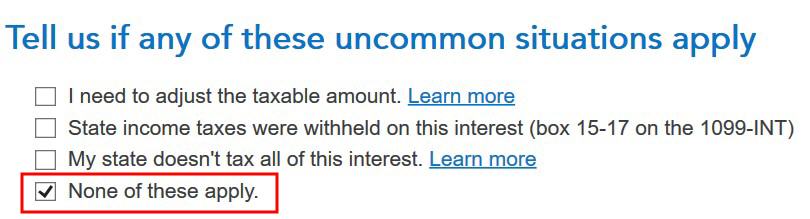

Examine on the field “None of those apply.” on the subsequent display. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3 on the earlier display.

Repeat the above steps in case you have a number of 1099-INT kinds from TreasuryDirect. Click on on Performed on the 1099-INT abstract display after you’re carried out with all of the 1099-INT kinds.

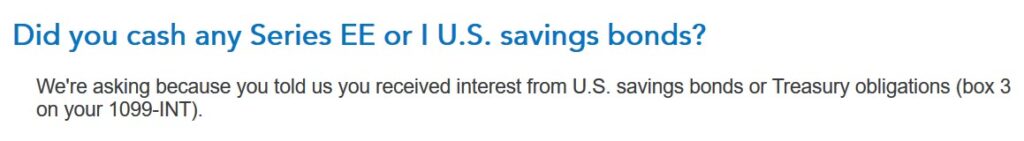

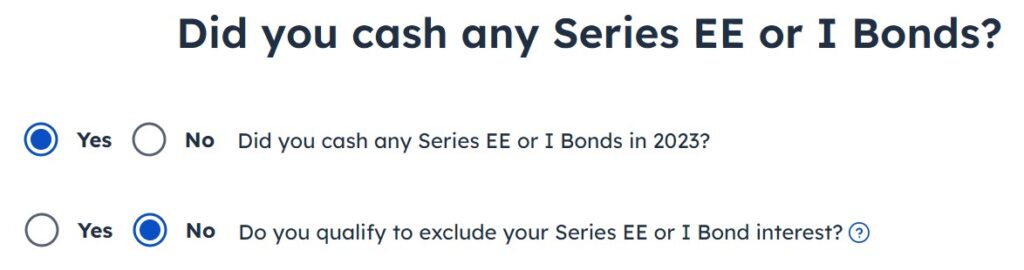

TurboTax asks whether or not you cashed Sequence EE or I U.S. financial savings bonds in case you qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan). Reply Sure if you need TurboTax to test your eligibility. Reply No in case you didn’t use the cash for school bills or put it right into a 529 plan or if you already know for certain you don’t qualify as a result of your earnings is above the restrict.

H&R Block

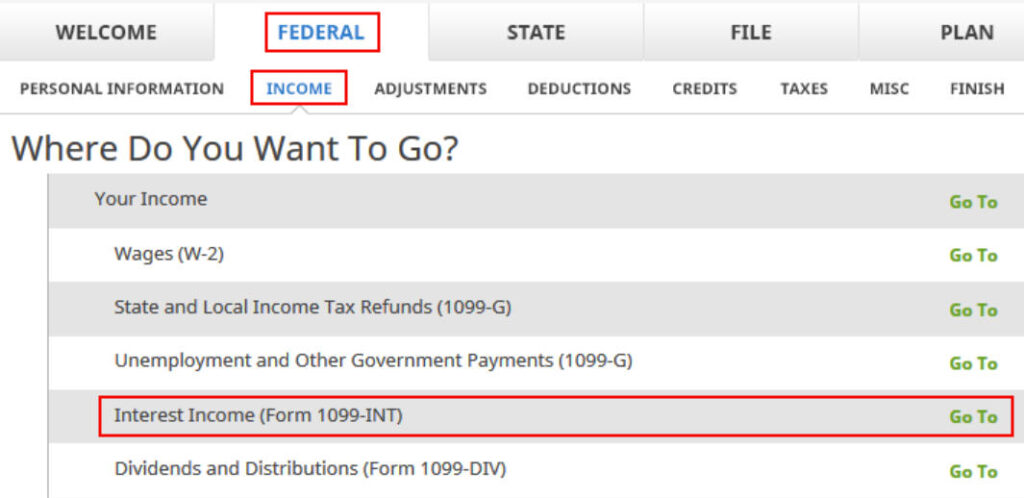

H&R Block tax software program has it beneath Federal -> Revenue -> Curiosity Revenue (Type 1099-INT). Enter one manually as a result of TreasuryDirect doesn’t assist importing the shape.

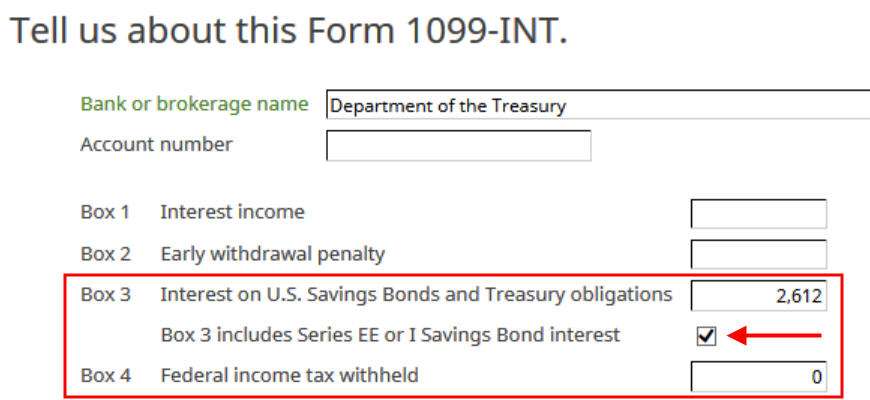

Enter “Division of the Treasury” because the financial institution or brokerage identify. The account quantity could also be non-obligatory however you’ll discover it on the 1099 type in case you want it. Enter the totals from the 1099 type into Field 3 and Field 4 and test that field “Field 3 contains Sequence EE or I Financial savings Bond curiosity.”

Depart Field 1 clean. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3.

Repeat the method in case you have a number of 1099 kinds from TreasuryDirect.

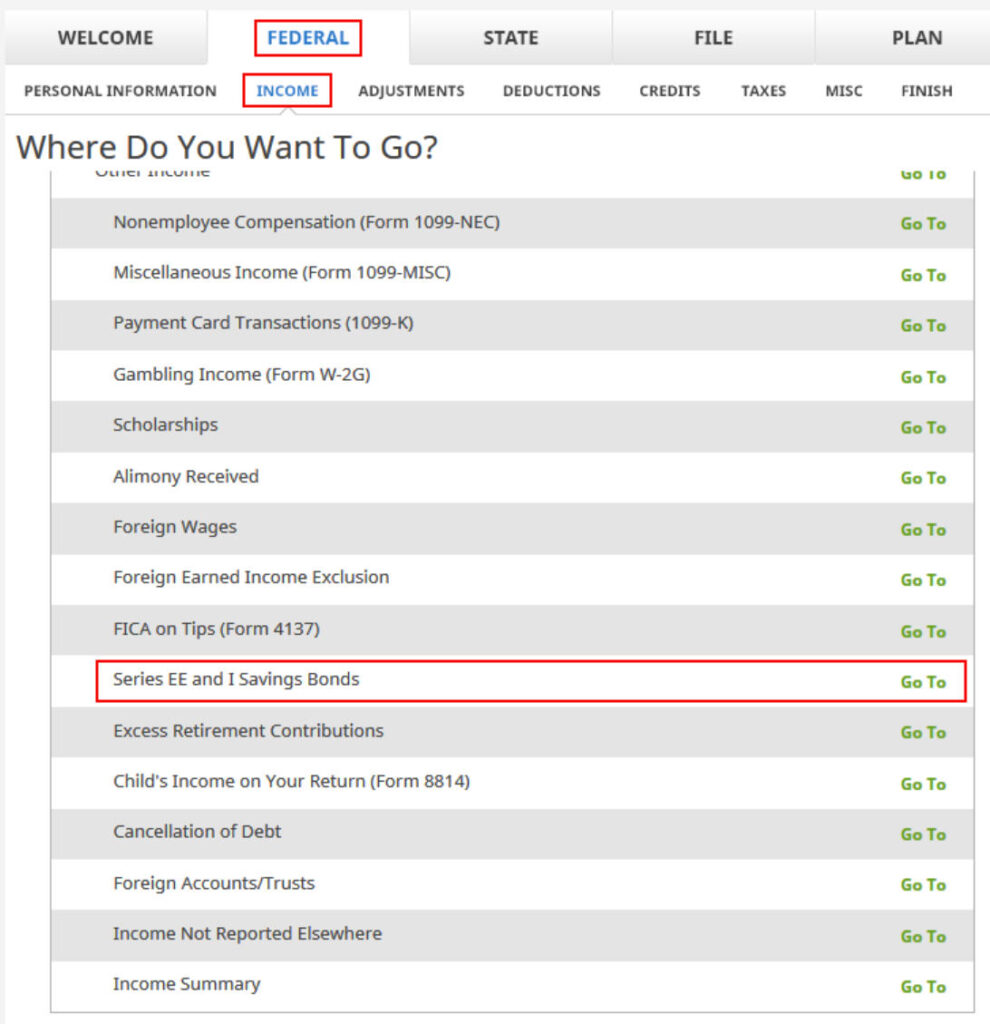

H&R Block doesn’t ask you about utilizing cash from financial savings bonds for school bills or placing it right into a 529 plan instantly. For those who assume you would possibly qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan), scroll down towards the underside of the Revenue part and go into “Sequence EE and I Financial savings Bonds.”

FreeTaxUSA

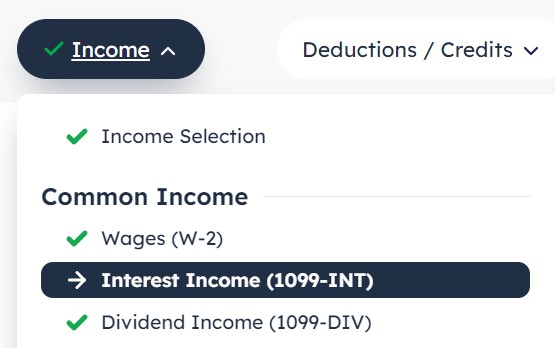

Go to the “Curiosity Revenue (1099-INT)” part beneath Frequent Revenue. Click on on “Add Curiosity Revenue” on that web page.

Enter “Division of the Treasury” because the Payer Title, the full curiosity in Field 3, and the tax withheld in Field 4. Depart Field 1 clean. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3.

Repeat the method in case you have a couple of 1099-INT from TreasuryDirect.

FreeTaxUSA asks whether or not you doubtlessly qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan). Reply Sure to the second query in case you used the cash for school bills or put it right into a 529 plan. Reply No in case you didn’t try this or if you already know for certain you don’t qualify as a result of your earnings is just too excessive.

Pay Tax Yearly

You might be by yourself if select to pay tax on I Bonds curiosity yearly versus ready till you money out (see I Bonds Tax Therapy Throughout Your Lifetime and After You Die). You received’t get a 1099 type from TreasuryDirect whenever you don’t promote your I Bonds. You’ll need to make up a 1099 type for the tax software program.

Use the Financial savings Bond Calculator to calculate the change in redemption worth for every bond from the prior December to final December. Report the full change as your curiosity for the 12 months in Field 3 of the made-up 1099-INT.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]