[ad_1]

[Updated on January 30, 2024 for 2023 tax filing.]

If you earn curiosity from U.S. Treasuries in a taxable account, the curiosity is exempt from state and native taxes. How the curiosity is reported on tax types is determined by whether or not you maintain Treasuries straight or by means of mutual funds and ETFs.

Curiosity from Treasury Payments and Notes

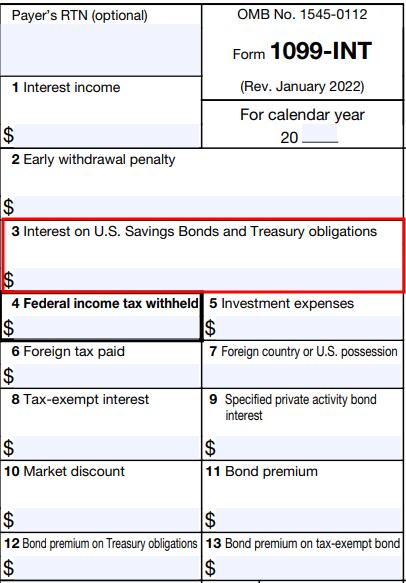

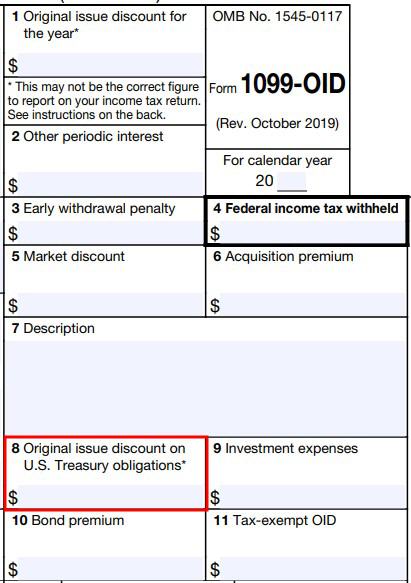

If you purchase particular person Treasuries in a taxable brokerage account — see How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and Find out how to Purchase Treasury Payments & Notes On the Secondary Market — you’ll see the curiosity reported on a 1099-INT kind and/or a 1099-OID kind (for TIPS).

Curiosity from Treasuries is reported individually in Field 3 on a 1099-INT kind.

Inflation adjustment for TIPS is reported individually in Field 8 on a 1099-OID kind.

Your tax software program is aware of about these particular bins within the tax types. Whether or not you import the tax types out of your dealer or enter them manually, the software program will robotically mark the curiosity as exempt out of your state revenue tax.

Treasuries in Mutual Funds and ETFs

Many cash market funds, bond funds, and bond ETFs maintain Treasuries. If in case you have these funds in a taxable brokerage account, a great a part of the funds’ dividends could have come from Treasuries. The portion of fund dividends attributed to curiosity from Treasuries isn’t certified dividends. It’s taxed at regular tax charges for federal revenue tax nevertheless it’s nonetheless exempt from state and native taxes.

When you’ve a number of mutual funds or ETFs in a taxable brokerage account, the dealer stories dividends obtained from all sources on one 1099-DIV kind. The 1099-DIV kind doesn’t have a particular field damaged out for dividends attributed to Treasuries. Your tax software program received’t understand how a lot of the dividends have been from Treasuries solely by the numbers on the 1099-DIV kind.

The dealer provides a breakdown of the dividends by supply. It’s as much as you to find out how a lot of the dividends from every supply got here from Treasuries. Suppose you personal 4 funds in a taxable brokerage account that paid $6,500 in complete dividends. Your aim is to fill out a desk like this with the share of dividends from Treasuries for every fund and calculate your complete dividends attributed to Treasuries:

| Fund | Whole Dividend | % from Treasuries | Dividend from Treasuries |

|---|---|---|---|

| Fund A | $500 | 0% | $0 |

| Fund B | $1,000 | 65% | $650 |

| Fund C | $2,000 | 10% | $200 |

| Fund D | $3,000 | 90% | $2,700 |

| Whole | $6,500 | $3,550 |

If you give the end result to your tax software program, it then is aware of to exempt that portion of the dividends from state and native taxes.

Authorities % from Fund Managers

Though the 1099-DIV kind and the dividend breakdown by funds are offered by the dealer, you’ll need to get the quantity for the “% from Treasuries” column from the managers of your mutual funds and ETFs.

In case you personal Vanguard mutual funds or ETFs in a Constancy brokerage account, you get this info from Vanguard, not from Constancy. Equally, when you personal iShares ETFs in a Charles Schwab brokerage account, you get the knowledge from iShares, not from Charles Schwab.

Google “[name of fund management company] tax heart” to seek out the knowledge from the fund supervisor.

Vanguard

Vanguard publishes the knowledge in its Tax Season Calendar. Search for “U.S. authorities obligations info.”

Constancy

Constancy publishes the knowledge in Constancy Mutual Fund Tax Data. Search for “Share of Earnings From U.S. authorities securities.” It’s anticipated to be accessible in early February.

Charles Schwab

Charles Schwab Asset Administration publishes the knowledge in its Distributions and Tax Heart. Search for “2023 Supplementary Tax Data.”

iShares

iShares publishes the knowledge in its Tax Library. Search for “2023 U.S. Authorities Supply Earnings Data.”

CA, NY, and CT Residents

California, New York, and Connecticut have extra necessities for exempting fund dividends earned from Treasuries. The fund administration firm will be aware in its printed info whether or not a fund met the necessities of CA, NY, and CT. If a fund didn’t meet the necessities, the Treasuries proportion is handled as 0% for CA, NY, and CT residents.

For instance, Vanguard Federal Cash Market Fund earned 49.37% of its revenue from U.S. authorities obligations in 2023. As a result of it didn’t meet the necessities of CA, NY, and CT, traders in these three states should nonetheless pay state revenue tax on 100% of this fund’s dividends. Folks in different states pay state revenue tax on solely 50.63% of this fund’s dividends.

Tax Software program

That you must give the end result to your tax software program after you get the “% from Treasuries” for every fund and calculate your dividend from Treasuries with a desk like this:

| Fund | Whole Dividend | % from Treasuries | Dividend from Treasuries |

|---|---|---|---|

| Fund A | $500 | 0% | $0 |

| Fund B | $1,000 | 65% | $650 |

| Fund C | $2,000 | 10% | $200 |

| Fund D | $3,000 | 90% | $2,700 |

| Whole | $6,500 | $3,550 |

It’s straightforward to overlook the entry level for this enter until you actually search for it.

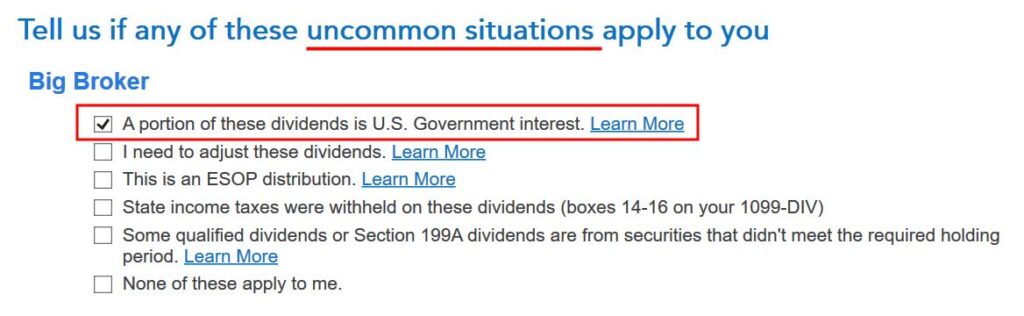

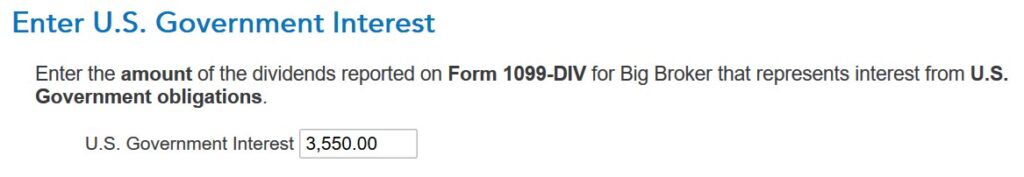

TurboTax

After you import or enter the 1099-DIV kind in TurboTax obtain software program, you might want to test a field to say {that a} portion of the dividends is U.S. Authorities curiosity. It’s straightforward to overlook as a result of TurboTax says it’s unusual, which isn’t true.

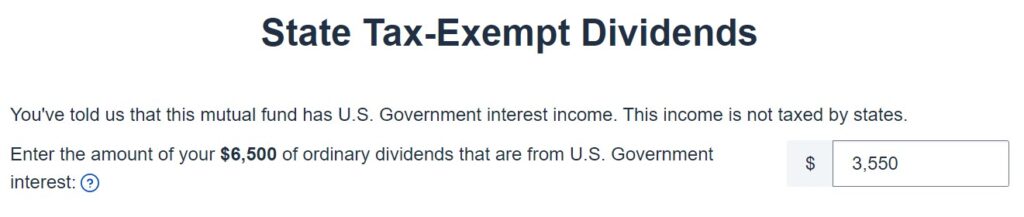

Now you enter the quantity you calculated in your desk.

Repeat this course of to your different 1099-DIV types.

H&R Block

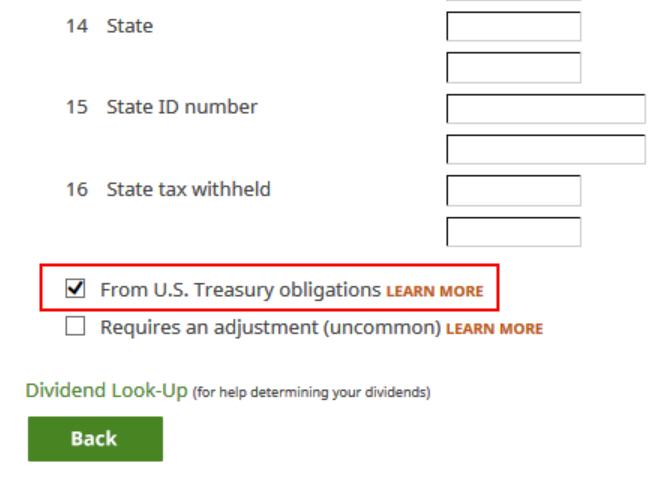

H&R Block obtain software program exhibits a checkbox on the backside of the 1099-DIV entries. This subject doesn’t come within the import. It’s straightforward to overlook as a result of it’s on the backside of a protracted kind. It’s a must to actually search for it. Verify it and click on on Subsequent.

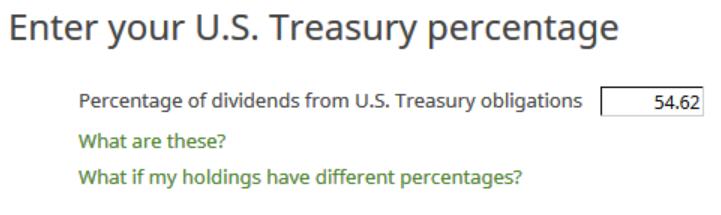

This exhibits up provided that you test that field on the earlier display. As an alternative of asking for a greenback quantity, H&R Block goes by proportion. It forces you to do a little bit of math. In our instance, $3,550 from Treasuries divided by $6,500 complete odd dividends is 54.62%. So we enter 54.62.

Repeat this course of for each 1099-DIV. H&R Block software program will preserve a tally of your state tax-exempt dividends.

FreeTaxUSA

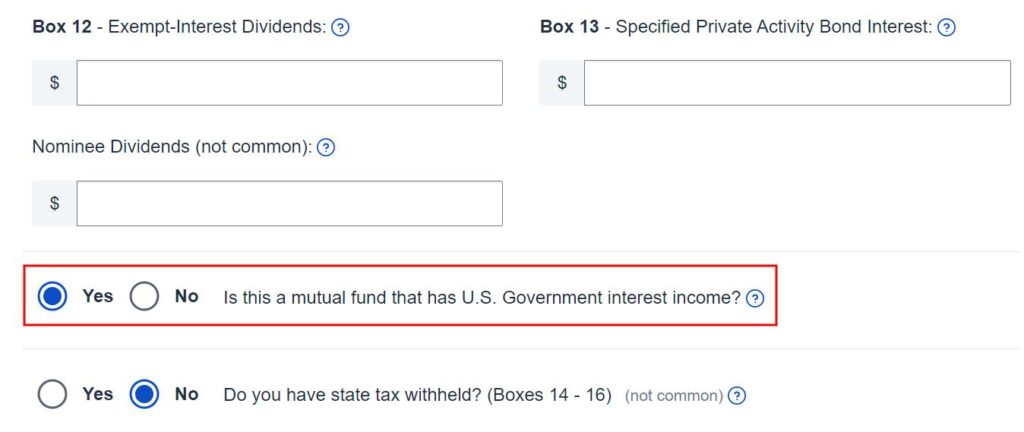

FreeTaxUSA has a radio button on the backside of the 1099-DIV entries. It’s straightforward to overlook as a result of it’s on the backside of a protracted kind. It’s a must to actually search for it. The query “Is that this a mutual fund … ?” isn’t correct. It needs to be “Does this embrace … ?”

Now you give the greenback quantity out of your desk.

***

Many of the work in calculating the quantity of the fund dividends exempt from state and native taxes is in searching down the share of revenue from Treasuries for every fund and ETF in your taxable brokerage account. That you must give the calculated quantity to your tax software program, which doesn’t make it apparent the place the quantity ought to go.

An identical course of additionally applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from each federal revenue tax and state revenue tax (“double tax-free”). I cowl that subject in a separate publish State Tax-Exempt Muni Bond Curiosity from Mutual Funds and ETFs.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]