[ad_1]

A lengthy field unfold commerce earns a little bit greater than shopping for Treasuries or CDs. A brief field unfold commerce provides you a mortgage at a superb fee. For those who commerce field spreads, whether or not lengthy or brief, you’ll must report taxes on these trades.

Kind 1099-B

Closed contracts generate realized good points and losses. Open contracts on the finish of the yr are “marked to market” and also you pay taxes on any unrealized good points and losses as much as that time.

The dealer will embody the mandatory info on a 1099-B type. The 1099-B type could also be part of the dealer’s consolidated 1099 type bundle. I’m utilizing the 1099-B type from Constancy for example. The shape from a unique dealer works equally.

Constancy studies field unfold contracts in three sub-sections in its consolidated 1099 bundle. Discover the heading “Part 1256 Choice Contracts” beneath “Kind 1099-B 20xx Proceeds from Dealer and Barter Alternate Transactions.”

Constancy provides a complete realized acquire or loss after an in depth itemizing of all of the closed contracts.

“Whole 8” refers to Field 8 on the 1099-B. A list of unrealized acquire or loss on open contracts as of 12/31 of the prior yr seems subsequent.

“Whole 9” refers to Field 9 on the 1099-B. If that is the primary yr you traded field spreads, this part is empty and the overall is zero. Lastly, you have got an inventory of unrealized good points or losses on open contracts as of 12/31.

“Whole 10” refers to Field 10 on the 1099-B. The Field 10 itemizing and whole this yr will turn out to be the Field 9 itemizing and whole subsequent yr. The Field 11 quantity “combination revenue or loss on contracts” is calculated as:

Realized This 12 months (Field 8) – Unrealized Prior 12 months (Field 9) + Unrealized This 12 months (Field 10)

You first cut back the realized good points by the unrealized good points you already paid taxes on the earlier yr. Then you definitely add the unrealized good points on contracts you held open as of December 31.

This Field 11 quantity is the crucial information level in your taxes on field unfold trades. For those who import 1099 types into tax software program, the numbers in Containers 8 by way of 11 could not come by way of. My import from Constancy didn’t deliver them over. I needed to enter the quantity into the software program by hand.

Right here’s methods to put the knowledge from the dealer into tax software program TurboTax, H&R Block, and FreeTaxUSA.

TurboTax

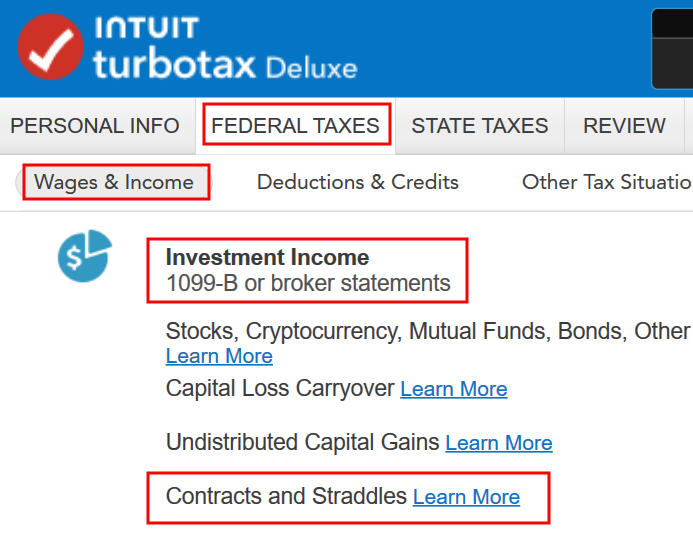

Go to “Federal Taxes” -> “Wages & Revenue.” Discover “Contracts and Straddles” within the “Funding Revenue” part in TurboTax. Click on on “Begin.”

Field spreads fall beneath Part 1256 contracts. Reply “Sure.”

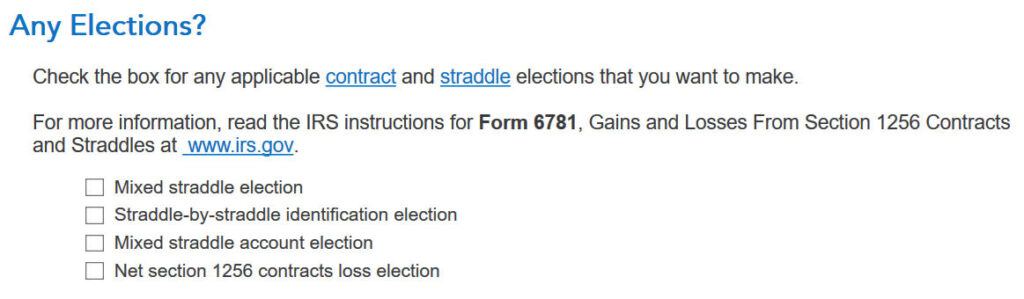

Preserve it easy and depart all the things clean right here.

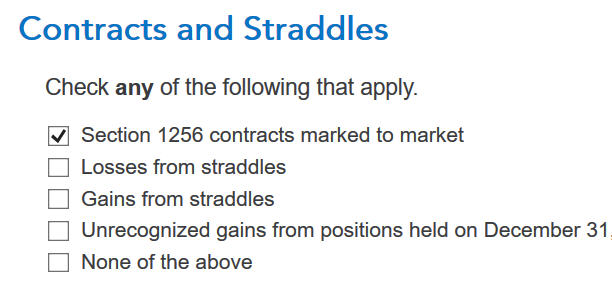

Solely verify the primary field “Part 1256 contracts marked to market” except you even have one thing else apart from field spreads.

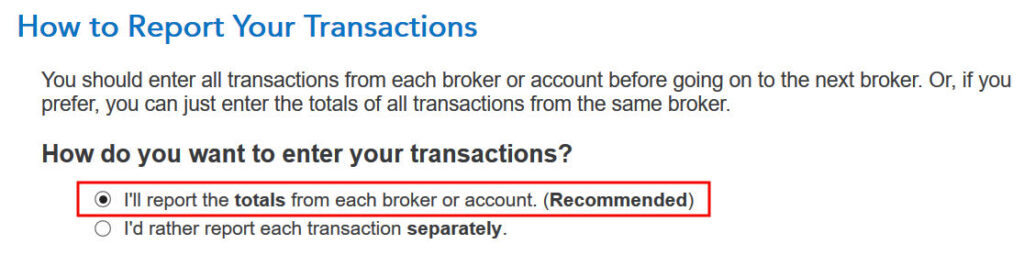

Take the really helpful strategy to report the totals from every dealer.

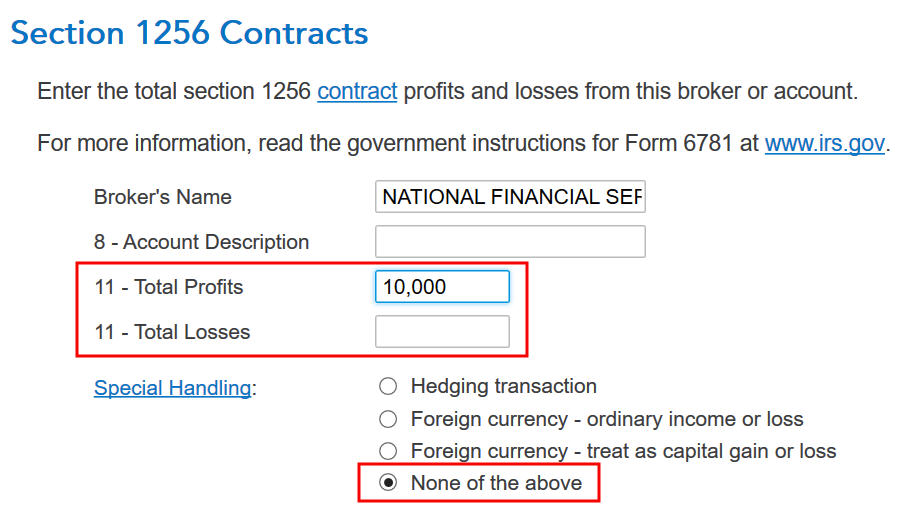

Enter the dealer’s title as proven on the 1099-B type. If Field 11 reveals a revenue, put it within the Whole Earnings field. If it reveals a loss, put it within the Whole Losses field as a optimistic quantity. Particular Dealing with defaults to “Not one of the above.” Preserve it that approach.

You’re achieved with one dealer. Click on on “Add” and repeat in case you additionally traded field spreads at one other dealer.

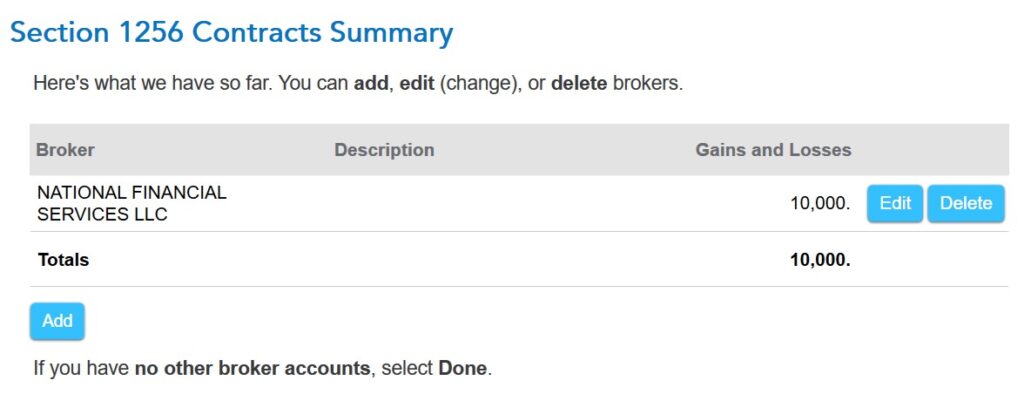

Earlier than you click on on “Accomplished” on the “Part 1256 Contracts Abstract” display screen, let’s see how the overall revenue or loss reveals up on the tax return.

Click on on “Types” on the high.

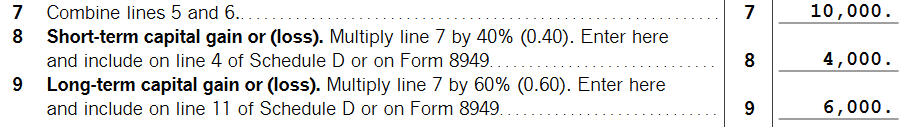

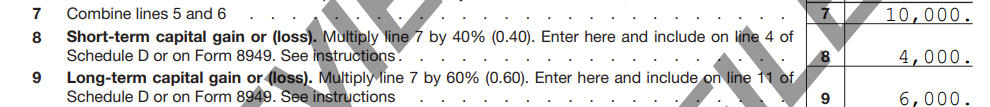

If Kind 6781 doesn’t open routinely, discover it within the checklist of types on the left. Scroll down on the proper to Strains 7 – 9. You see right here that the overall revenue from field spreads is damaged down as 40% short-term capital acquire and 60% long-term capital acquire.

Click on on “Step-by-Step” on the high to return to the interview.

H&R Block

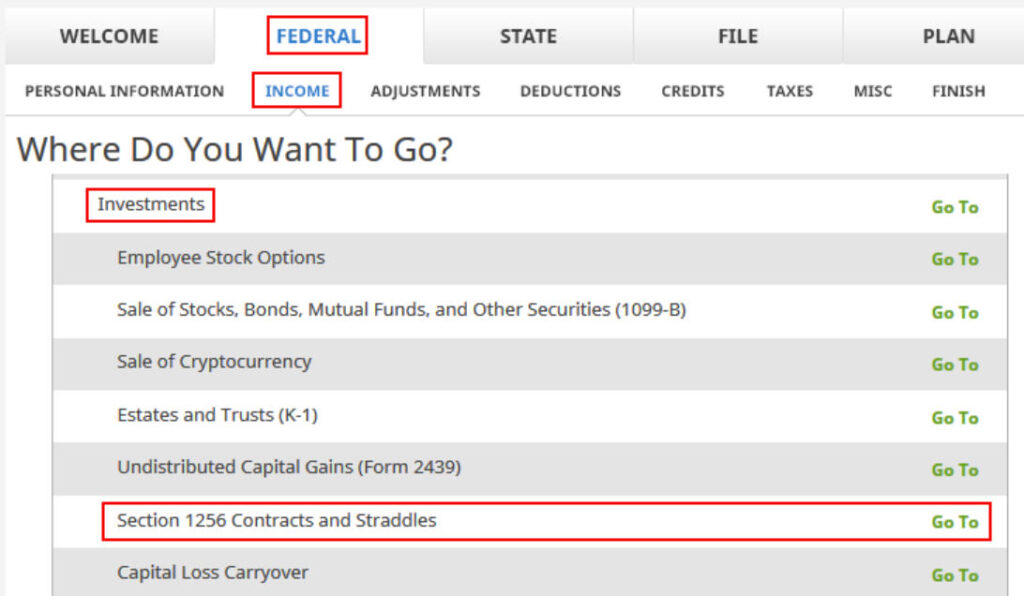

In H&R Block tax software program, click on on Federal -> Revenue. Scroll down to search out “Part 1256 Contracts and Straddles” within the Investments part.

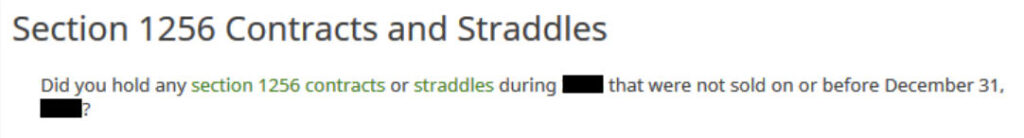

H&R Block asks you whether or not you had any open contracts as of December 31. You need to reply “Sure” right here even in case you didn’t have any open contracts as of December 31 as a result of H&R Block will finish the interview abruptly in case you reply “No.”

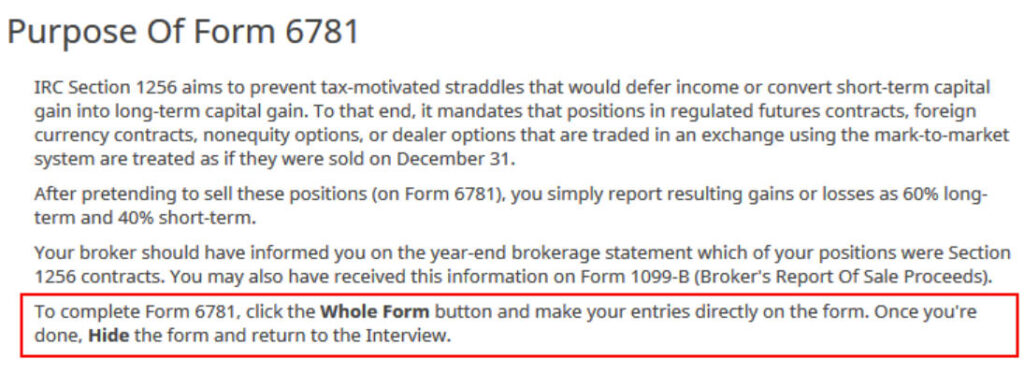

H&R Block goes into the lazy mode once more. It needs you to fill out Kind 6781 immediately your self with out a lot steerage. Click on on “Complete Kind” to develop the shape under.

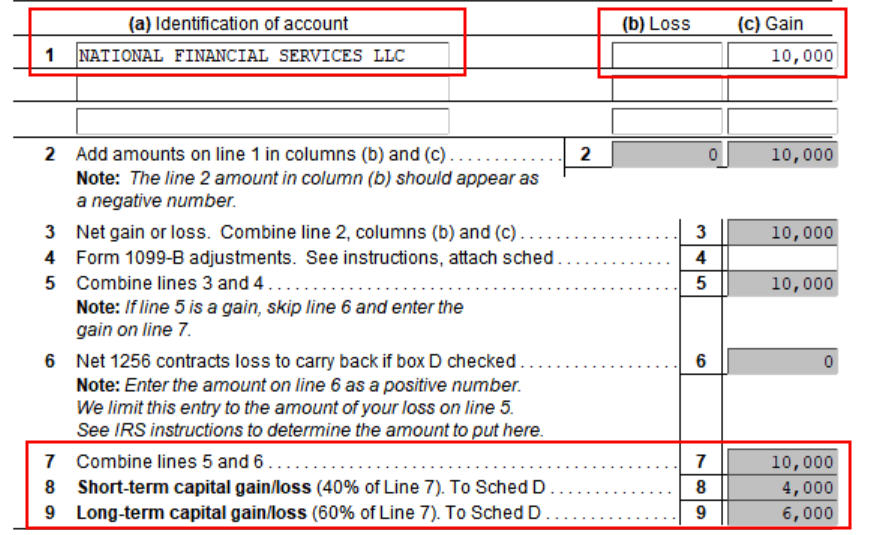

Fortunately the shape isn’t too difficult if solely you understand what to do with it. Put the title of the dealer from the 1099-B in Line 1 column (a). If the quantity from Field 11 of the 1099-B (“combination revenue or loss on contracts“) is a loss, put it in Line 1 column (b) as a optimistic quantity. If it’s a revenue, put it in Line 1 column (c).

The remainder of the strains calculate routinely. You see the combination revenue is damaged into 40% short-term capital acquire and 60% long-term capital acquire.

FreeTaxUSA

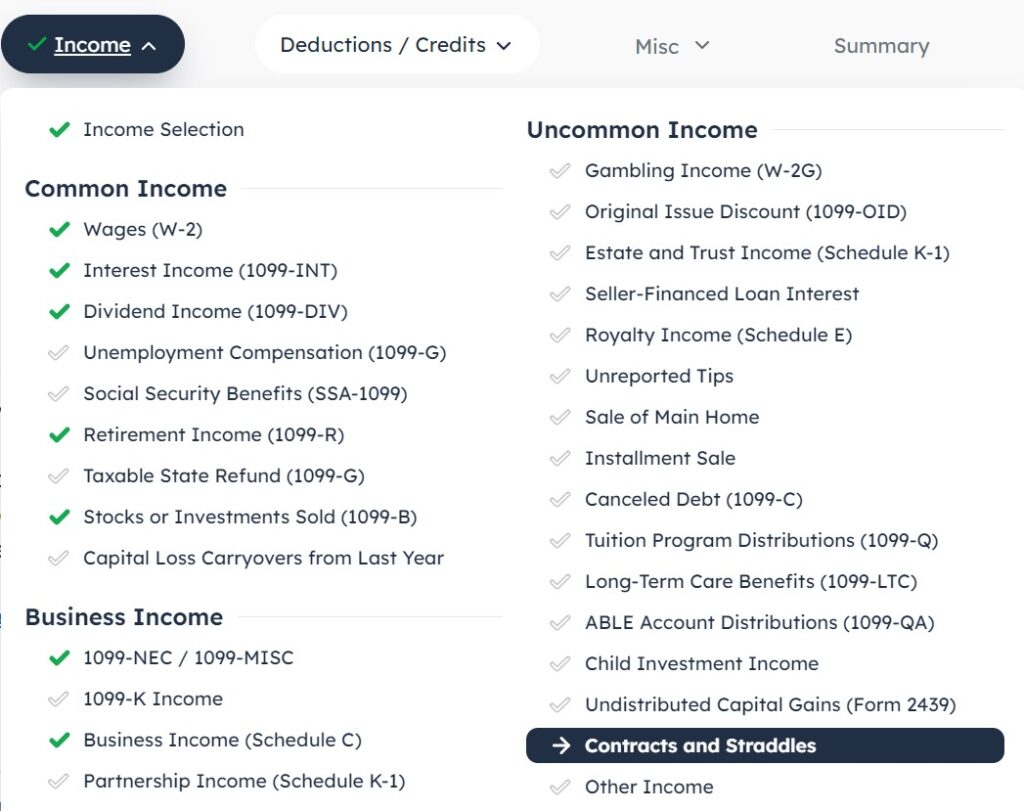

In FreeTaxUSA, discover “Contracts and Straddles” beneath Unusual Revenue within the Revenue part.

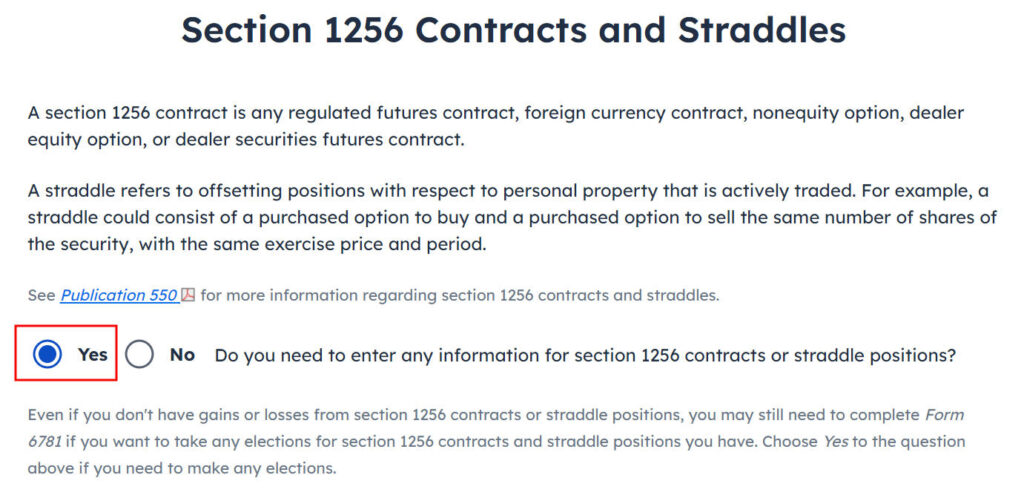

Reply “Sure” to get into the interview.

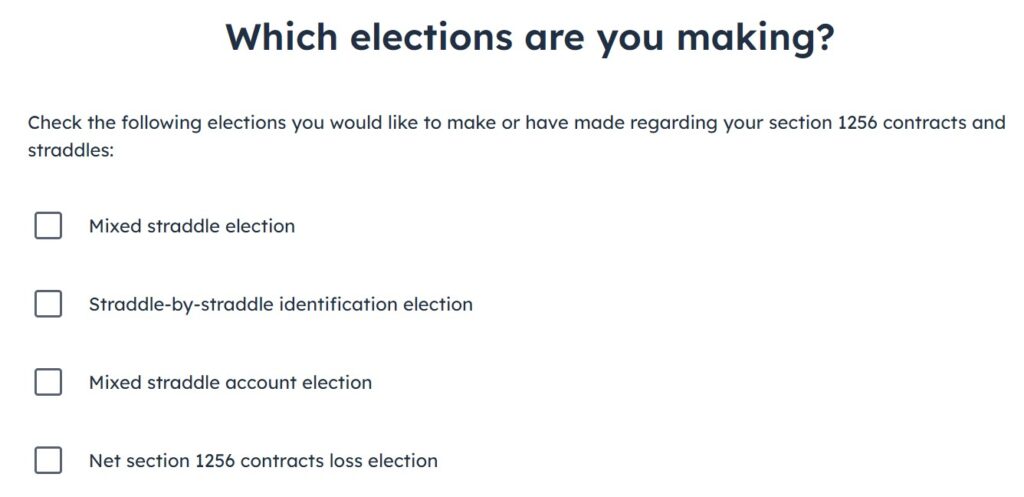

Preserve it easy and depart all the things clean right here.

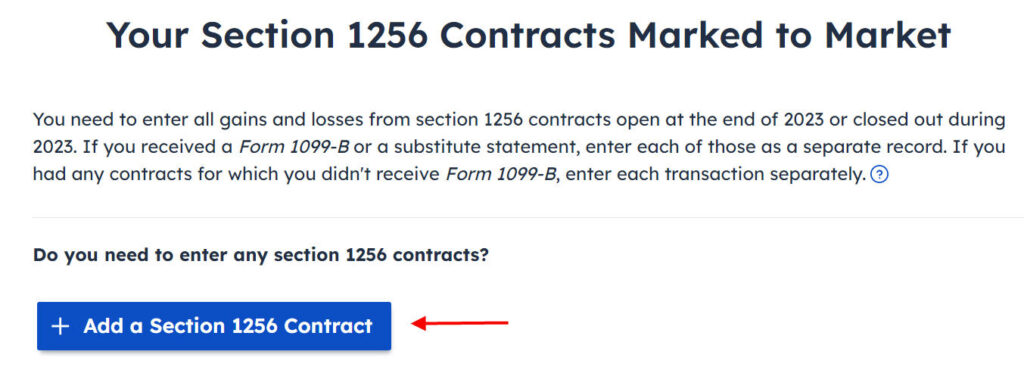

Click on on the “Add a Part 1256 Contract” button. Though the blurb and the button give the impression that you could add every contract individually, the following display screen will point out that you would be able to enter solely the overall quantity.

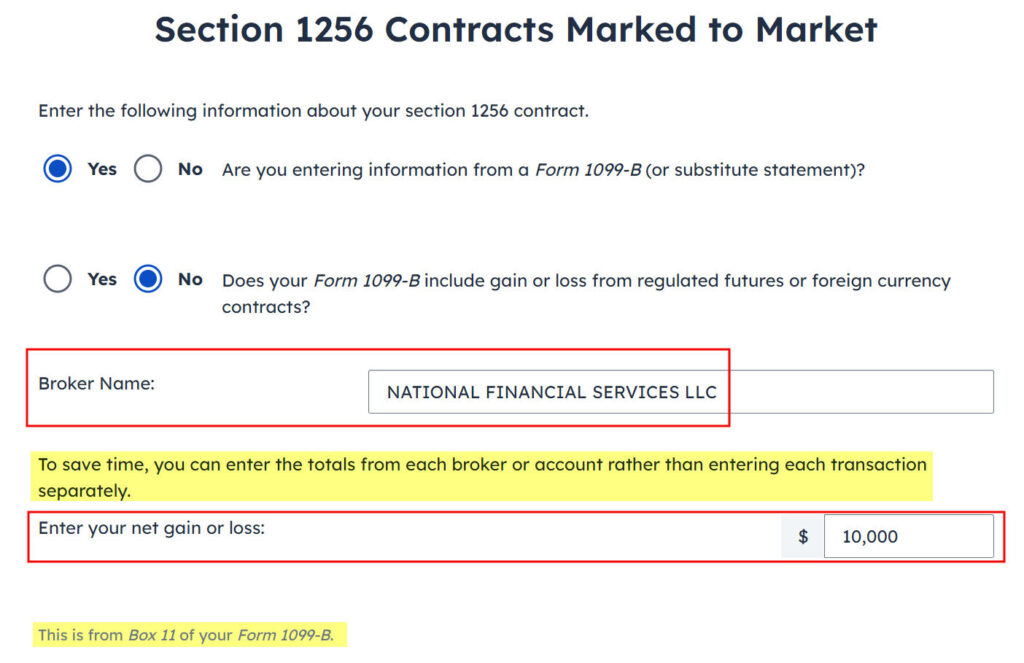

Enter the title of the dealer and the overall revenue or loss from Field 11 of the 1099-B type. Enter a unfavorable quantity if it’s a loss.

Repeat so as to add one other 1099-B in case you traded field spreads at one other dealer.

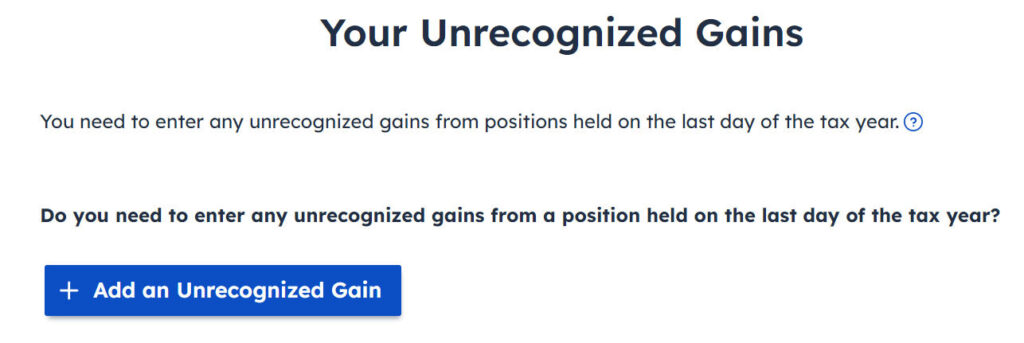

Click on on “No, Proceed” right here as a result of field spreads aren’t straddles.

Click on on “No, Proceed” right here despite the fact that you do have unrecognized good points or losses in open contracts held December 31 as a result of these unrealized good points and losses are already included within the combination revenue or loss in Field 11 of the 1099-B.

To confirm that the software program handled the good points or losses accurately, scroll all the way down to the underside of the earnings abstract web page and discover the small “view PDF” hyperlink beneath Contracts and Straddles.

You see it’s damaged into 40% short-term capital acquire and 60% long-term capital acquire.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]